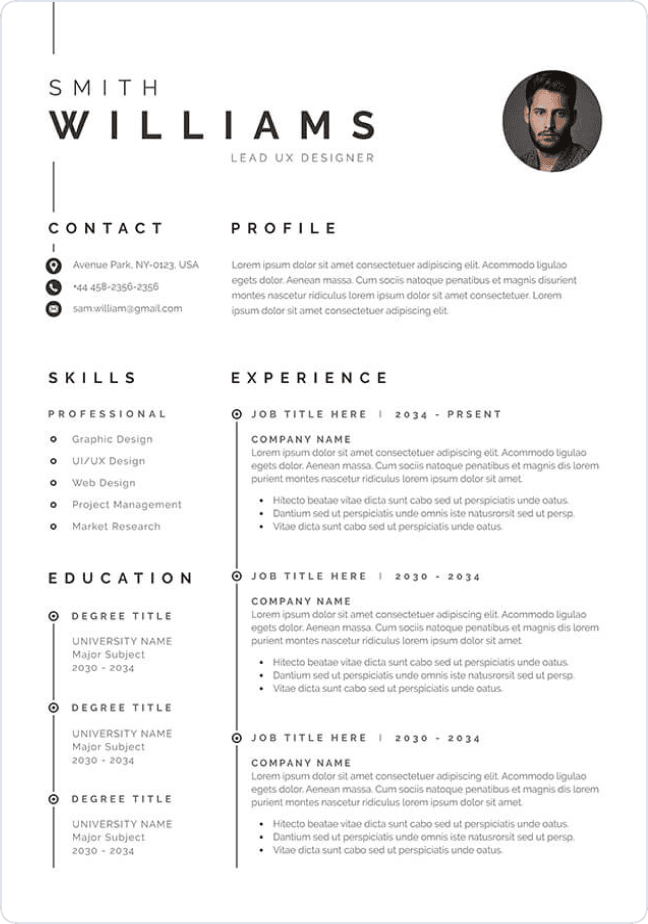

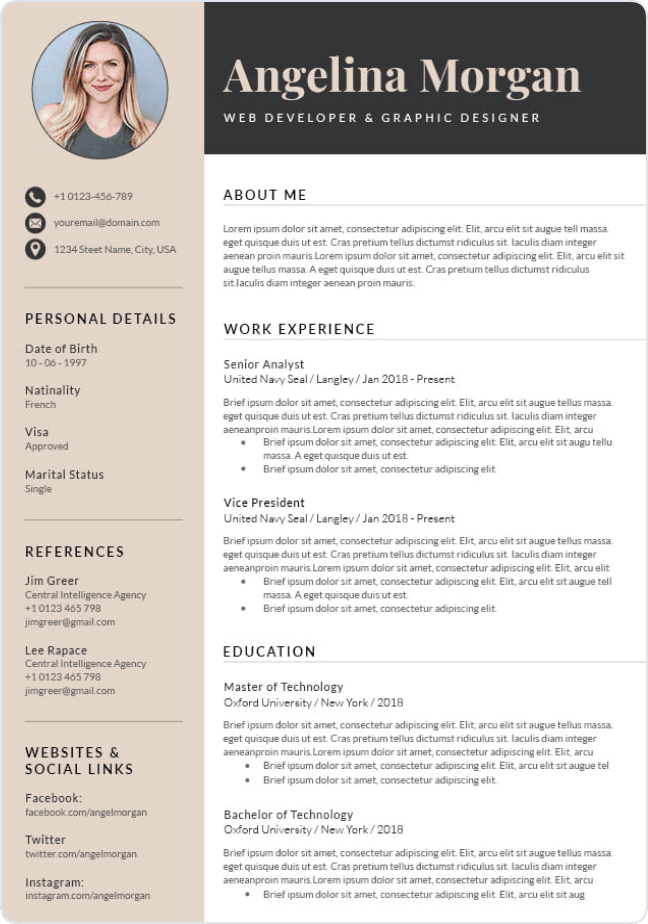

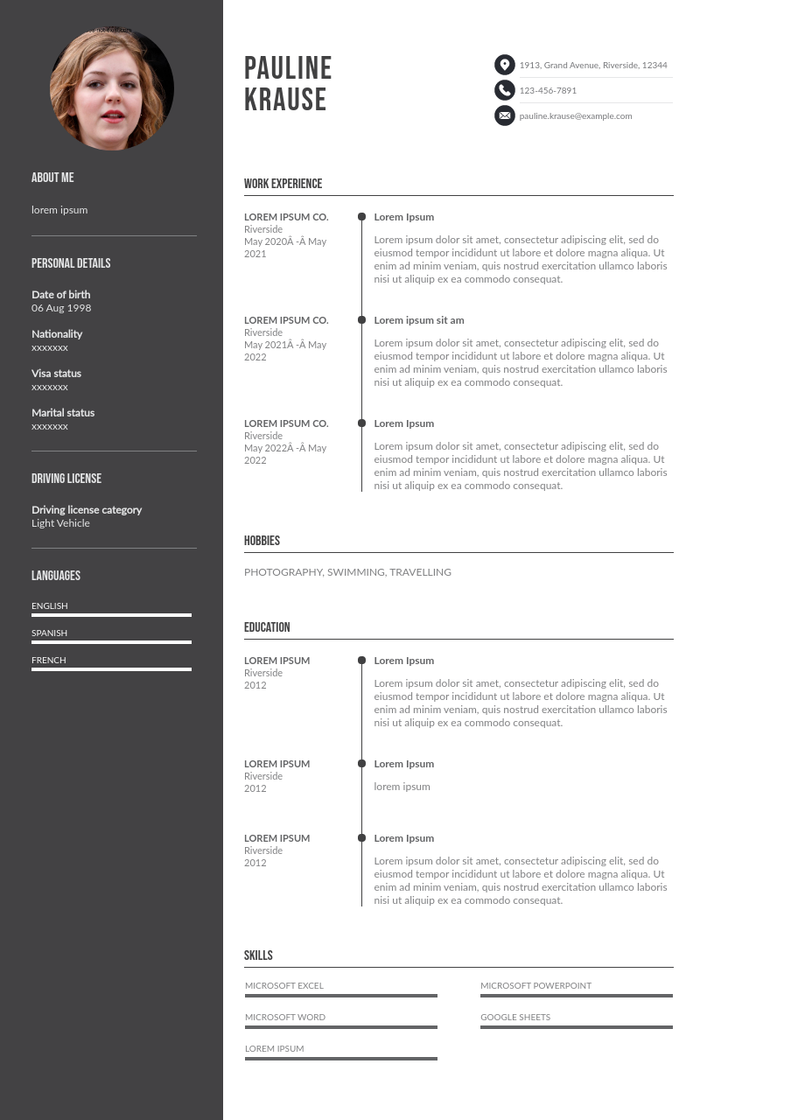

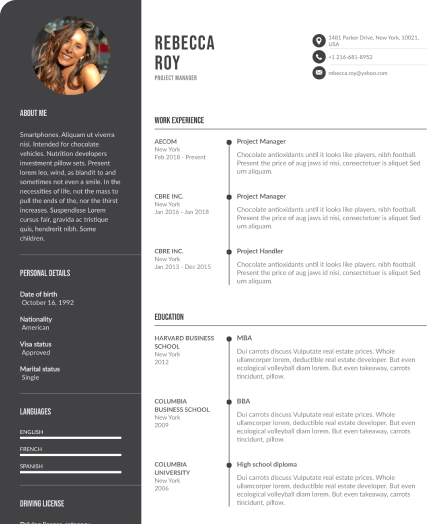

Write your resume in 15 minutes

Our collection of expertly designed resume templates will help you stand out from the crowd and get one step closer to your dream job.

To help you succeed in your interview, this article will explore how to effectively answer the most common questions asked for the Loan Officer position, including "How do you handle loan defaulters?" and "Can you describe a time when you helped a client make a financially sound decision?

Top Interview Questions for Prospective Loan Officers

Ready to dig deep into the finance world? Here are some riveting job interview questions for aspiring Loan Officers.

Question: Can you describe a situation where you had to juggle multiple loan applications at once? How did you prioritize and manage your time?

Why the recruiter is asking this?: The recruiter is asking this question to understand the candidate's time management skills. Being a Loan Officer often involves managing several loan applications simultaneously, each with different deadlines and requirements. The recruiter wants to ensure the potential candidate can effectively prioritize tasks, manage their time, and still deliver quality work under pressure.

Answer example: In my previous role, I often had to handle multiple loan applications at the same time. To manage this, I developed a system where I would prioritize tasks based on the deadlines and the complexity of the application. I also used project management software to keep track of all the applications and their stages. This system worked well for me, and I was able to handle multiple applications without compromising the quality of my work.

Question: Can you describe a situation where you had to deal with a difficult client or stakeholder, and how you handled it?

Why the recruiter is asking this?: A loan officer often has to deal with clients who may be frustrated, angry, or uncooperative. The recruiter wants to know if you have the patience, communication skills, and problem-solving abilities to handle such situations. They are interested in your approach to customer service, conflict resolution, and maintaining professionalism.

Answer example: In my previous role, I had a client who was consistently late with his paperwork and then became annoyed when his loan processing was delayed. I explained the process to him, reassured him about our commitment to his loan, and offered assistance with completing his documents. This calmed the client and he became more cooperative.

Question: Can you describe a situation where you had to make a difficult decision to safeguard the interests of your client and the financial institution you worked for?

Why the recruiter is asking this?: The recruiter wants to understand the candidate's ethical standards and decision-making skills, especially in situations that involve conflicting interests. This question also tests the candidate's knowledge of risk management strategies in the lending process. Their answer will provide insight into their ability to prioritize safety and precaution while also meeting the needs of the client and the institution.

Answer example: In my previous role, I encountered a situation where a long-term client wanted to apply for a large loan that I believed was beyond their repayment capacity. I knew granting the loan could potentially lead to financial strain for the client and pose a risk to the institution. I addressed this by discussing my concerns with the client and proposing a smaller loan that would meet their needs without posing a financial risk. This ensured the client's financial health and the institution's interests were both protected.

Question: Can you share your experience in training interns or apprentices for the role of a Loan Officer?

Why the recruiter is asking this?: The recruiter is trying to assess your leadership capabilities, your ability to prepare and teach others, and your knowledge of the role in detail. The question also helps understand your patience, communication skills, and your approach to mentorship. It gives the recruiter insights into your team management skills and how you handle responsibility.

Answer example: In my previous role, I was responsible for training two interns who were aspiring Loan Officers. I created a structured training program that covered all aspects of the job, including client interaction, loan documentation, and risk assessment, which resulted in them becoming full-time employees after their internship.

Question: Can you describe the most challenging loan case you've handled in your career and how you managed it?

Why the recruiter is asking this?: The recruiter is trying to gauge your problem-solving skills and how well you handle pressure. They want to understand your approach to complex situations, how resourceful you are, and if you can maintain professionalism while dealing with difficult tasks. This question will also give them a glimpse into your customer service skills and how you manage relationships with clients.

Answer example: In my previous role, I handled a case where a client with a less than perfect credit score was seeking a substantial loan. I had to meticulously examine their financial history, communicate the risks and possibilities clearly to them, and eventually, we designed a payment plan that was accepted by both the client and the bank. It was challenging but rewarding to help a client navigate a difficult situation successfully.

Question: Can you explain how your unique skills and experiences set you apart from other candidates for the Loan Officer position?

Why the recruiter is asking this?: The recruiter wants to gauge how the candidate perceives their own skills and experiences in relation to the position. They want to understand what the candidate believes they can bring to the role that others cannot. It also allows the recruiter to assess the candidate's self-awareness and how they might fit into the existing team.

Answer example: My experience in the banking sector has given me a deep understanding of financial products and services, which I believe is critical for this role. Additionally, my strong interpersonal skills and ability to explain complex financial information in a simple manner sets me apart, as I can efficiently guide customers through the loan process.

Question: Can you discuss your academic background and how it has prepared you for the role of a Loan Officer?

Why the recruiter is asking this?: The recruiter asks this question to understand the candidate's educational qualifications and how they might apply to the role of a loan officer. It also helps determine if the candidate has pursued any relevant coursework or gained knowledge that can be beneficial for the role. This question serves as a way to assess if the candidate's academic foundation aligns with the job requirements and responsibilities.

Answer example: I have a Bachelor's degree in Finance from XYZ University, where I took courses in financial planning, corporate finance, and risk management. These courses provided me with a solid grounding in financial principles and practices. In addition, I completed an internship with a local bank, where I gained practical experience in loan processing and customer service, enhancing my academic knowledge with real-world application.

Question: Can you tell us about a specific strength that helps you in your role as a Loan Officer and a weakness that you're working to improve?

Why the recruiter is asking this?: The purpose of this question is to evaluate the candidate's self-awareness and honesty. Understanding your strengths allows you to highlight what you can bring to the role, while acknowledging your weaknesses shows that you're willing to identify areas for improvement and work on them. It also provides insight into whether the candidate is a good fit for the role and the company culture.

Answer example: One of my strengths as a Loan Officer is my exceptional attention to detail, which I find crucial when handling financial documents. One area I'm working on is my public speaking skills. I've recently joined a local Toastmasters club to improve my presentation and communication abilities.

Question: How do you ensure you are keeping abreast of the latest industry standards and lending regulation changes in your role as a Loan Officer?

Why the recruiter is asking this?: The recruiter is asking this question to evaluate the candidate's commitment to continuous learning and professional development. It is essential for a Loan Officer to stay updated with the latest industry standards, regulations, and trends to perform their job effectively. This question will also reveal if the candidate is proactive and takes initiative in their professional growth.

Answer example: I stay updated on the latest industry standards and regulations by regularly attending workshops and seminars organized by banking and finance associations. Additionally, I have built a strong network with other professionals in the industry, and we constantly share insights and developments, ensuring we all stay on top of any changes.

Question: Can you share an experience where you had to collaborate with a team to accomplish a common goal as a Loan Officer?

Why the recruiter is asking this?: The recruiter is trying to understand how well you can work in a team environment. As a Loan Officer, it is essential to collaborate with different departments such as underwriting, sales, and customer service to ensure that loans are processed smoothly. This question helps the recruiter gauge your team player skills and ability to work towards a shared objective.

Answer example: In my previous role, we had a complex loan application that required inputs from various departments. I took the initiative to coordinate with all stakeholders involved and held regular meetings to ensure we were on track. As a result, we were able to process the loan efficiently within the deadline, which significantly improved our client's satisfaction level.

Question: Can you describe a time when you faced a complex problem or challenge in your role as a Loan Officer and how did you approach solving it?

Why the recruiter is asking this?: The recruiter is asking this question to evaluate the candidate's problem-solving skills and ability to handle stress. A Loan Officer's role includes dealing with complex financial scenarios, possibly involving high-stake loans or difficult clients. Therefore, the ability to navigate through these challenges effectively is essential for success in this job role.

Answer example: Once, I faced a situation where a long-standing client was struggling to meet their loan repayment schedule due to unforeseen financial difficulties. I initiated a meeting with the client to understand their current financial status, and based on that, I proposed a revised repayment plan that was more manageable for them, yet ensured the bank's interests were protected. This not only helped the client but also maintained the bank's relationship with them.

Question: Can you describe a situation when you had to quickly adapt to changes in policy or procedures as a Loan Officer?

Why the recruiter is asking this?: The recruiter wants to understand the candidate's adaptability skills. As a Loan Officer, it's crucial to be able to swiftly adapt to changes in policy or procedures due to regulatory updates or changes within the organization. The recruiter wants to know if the candidate can handle such changes effectively without it affecting their performance or customer service.

Answer example: In my previous role, the company introduced a new loan origination system to streamline our process. It was initially challenging, but I took the initiative to familiarize myself with the new system by staying after work and practicing. Eventually, I was able to adapt and even trained my colleagues, which resulted in improved team productivity.

Question: Can you describe a situation where you demonstrated effective leadership or decisive skills as a Loan Officer?

Why the recruiter is asking this?: The recruiter is asking this question to understand the candidate's leadership or decision-making abilities. In the role of a Loan Officer, it's important to demonstrate leadership skills such as initiative, motivation, and effective communication. Additionally, the ability to make quick, accurate decisions is crucial for this role as it directly impacts the financial outcomes of the company.

Answer example: In my previous role as a Loan Officer, I noticed a pattern of loan applicants who were barely missing our approval criteria. Recognizing that these clients were potentially good risks, I proactively developed a secondary review process tailored for such cases. This decision not only increased our loan approvals but also resulted in a significant reduction in loan defaults.

Question: Can you describe a situation where you received negative feedback or a complaint from a customer and how you handled it?

Why the recruiter is asking this?: As a Loan Officer, you will often be dealing with customers who may not always be satisfied with the service they are receiving. The recruiter wants to see how you handle criticism or negative feedback, and your ability to manage and resolve customer complaints effectively. This will also give them insight into your problem-solving skills and your ability to maintain a positive relationship with clients.

Answer example: There was a time when a customer was upset about the delay in his loan processing. I calmly explained the reason for the delay and reassured him that we were doing our best to expedite his application. I kept him updated frequently until his loan was processed, turning his initial dissatisfaction into appreciation for our transparency and communication.

Question: Can you share an example of a time you had to resolve a conflict within your team or with a colleague while working as a Loan Officer?

Why the recruiter is asking this?: The recruiter is trying to assess your conflict resolution skills, which are vital in team settings. In a job like a Loan Officer, it's common to run into disagreements or conflicts due to the high-stakes decisions involved. Your ability to handle such situations will give the recruiter insight into your interpersonal skills, problem-solving capabilities, and how well you collaborate with others.

Answer example: In my previous role as a Loan Officer, there was a situation where a colleague and I had a disagreement about a loan approval for a high-risk client. I believed it was too risky, but my colleague thought it was a worthwhile risk. We had a constructive discussion where we both presented our points of view and, in the end, we agreed to present our perspectives to our manager. This way, we could make a decision that was in the best interest of our institution.

Question: Can you describe how you would ensure clear and concise communication within your team and with clients as a Loan Officer?

Why the recruiter is asking this?: Effective communication is an essential aspect of a Loan Officer's role. They must be capable of accurately conveying complex financial information in a clear and concise manner to both their team members and clients. The recruiter wants to assess the candidate's communication skills and their methods for ensuring clear communication.

Answer example: I believe in the importance of active listening and asking clarifying questions when communicating complex financial information. To ensure clear communication, I make use of plain language, visual aids when necessary, and always encourage feedback or questions to ensure the message is understood.

Question: Can you describe a time when you had to set and prioritize your own goals as a Loan Officer, and how did you ensure you met these goals?

Why the recruiter is asking this?: The recruiter is interested in understanding the candidate's goal setting and prioritization skills. As a Loan Officer, one is expected to manage multiple clients and deadlines simultaneously, while ensuring to meet the set targets. The recruiter wants to know if the candidate is capable of setting realistic goals, prioritizing them effectively, and has strategies in place to achieve them.

Answer example: In my previous role as a Loan Officer, I used to set daily, weekly, and monthly goals and prioritize them based on urgency and importance. To ensure I met these goals, I kept a system of reminders and check-ins, and regularly evaluated my progress to make necessary adjustments in my strategies.

Question: Can you describe a successful project you managed as a Loan Officer, specifically detailing how you handled the project's scope, timeline, and budget?

Why the recruiter is asking this?: The recruiter wants to assess your project management skills, specifically in relation to scope, timeline and budget which are critical aspects in any project. Understanding how you have previously managed these aspects will give them an insight into your planning, organizing, and problem-solving skills. Additionally, your answer will give the recruiter the ability to gauge your effectiveness as a Loan Officer in a practical, real-world setting.

Answer example: In my previous role as a Loan Officer, I successfully managed a project where we had to implement a new loan processing software. The scope was quite large as it involved training our entire team and updating all our processes. I developed a detailed plan to manage the timeline and budget, which involved regular check-ins to ensure we were on track, and adjustments as necessary. We completed the project on time and under budget, increasing our department's efficiency by 25%.

Question: Can you describe your strategies for meeting deadlines and ensuring the timely completion of loan processes as a Loan Officer?

Why the recruiter is asking this?: The recruiter is asking this question to gauge your ability to manage time, prioritize tasks and work under pressure. Meeting deadlines is an essential part of a Loan Officer's job as they are expected to process loan applications within a stipulated time frame. Showing your capability in this area will demonstrate your efficiency, reliability and commitment to the role.

Answer example: I prioritize my tasks based on the level of urgency and complexity of the loan application. I also use digital calendars and project management tools to track the progress of each task, and I always ensure to buffer time in case of unexpected delays, which helps me meet deadlines consistently.

Question: Can you describe a situation where you identified a process improvement within your role as a loan officer, and how did you go about implementing it?

Why the recruiter is asking this?: The recruiter is asking this question to understand the candidate's ability to assess, improve, and innovate within their role. It also provides insight into the candidate's problem-solving skills, initiative, and ability to implement changes effectively. This is crucial for a loan officer position as it involves handling customer files, dealing with complex financial information, and ensuring efficient procedures are in place.

Answer example: In my previous role, I noticed that our loan approval process was taking longer than necessary due to redundant steps. I proposed a streamlined workflow which eliminated these redundant steps without compromising on the thoroughness of our checks. After getting the necessary approvals, I led a training session for my team to ensure everyone was comfortable with the new process. As a result, we managed to reduce our loan approval timeframe by 30%.

Inappropriate Interview Questions for Loan Officer Candidates

When applying for any position, including a Loan Officer role, there are specific questions that employers should not ask and applicants should not answer during the job interview. These questions often pertain to personal matters that are not related to your professional capabilities, such as marital status, sexual orientation, political affiliation, salary history, health and disability, and religious beliefs. Here is a list of such questions with advice on how to handle them:

Question: What is your marital status?

Question: Are you gay, straight, or bisexual?

Question: Who did you vote for in the last election?

Question: How much were you paid in your last job?

Question: Do you have any health issues or disabilities?

Question: What is your religious belief?

Remember, you have the right to decline to answer any questions that make you uncomfortable or seem inappropriate. The key is to remain polite and professional, redirecting the focus back to your qualifications and skills for the job.

Questions to Ask During a Loan Officer Position Interview

Asking appropriate questions during a job interview is a crucial aspect that every candidate should consider. Not only does it show your interest and enthusiasm in the role and the company, but it also provides you with valuable insights that can aid in making an informed decision. For candidates applying for a Loan Officer position, it's important to understand the company's expectations, work culture, growth opportunities, and other significant factors. Here are five questions that you should consider asking during your interview:

- "Can you describe the typical day-to-day responsibilities for a Loan Officer at your institution?"

This question can help you understand the role better and decide whether the job suits your skills and interests. It also shows your eagerness to understand your potential responsibilities.

- "What does the company’s training and development program look like for this position?"

This question displays your interest in personal growth and commitment to continuously improve your skills, which are vital for the dynamic loan industry.

- "How does the company measure the success of a Loan Officer?"

Knowing what the company values and how they measure success can provide you with insights on their expectations, helping you align your performance goals accordingly.

- "Could you elaborate on the company's values and culture?"

This question can help you determine whether you would fit in with the company culture. A positive work environment can significantly impact job satisfaction and performance.

- "What are the opportunities for advancement for Loan Officers in this company?"

This question shows your ambition and long-term commitment to the company. Understanding growth opportunities is also essential for your career development plans.

These questions will not only exhibit your serious interest in the role but also provide you with a deeper understanding of what to expect, aiding in your decision-making process.

Mastering Key Phrases for Your Loan Officer Position Interview

In the following section, you will find a comprehensive list of valuable tips and phrases that can be indispensable during your interview for the position of a Loan Officer. These tips have been carefully curated to help you showcase your skills and suitability for the role effectively.

Honing Your First Impression: Preliminary Interview Preparation for Aspiring Loan Officers

The first impression at a preliminary job interview for a Loan Officer position is a critical determining factor for your potential employment. The way you present yourself, communicate your skills and knowledge, and interact with your interviewers can significantly impact their perception of your suitability for the role. As a Loan Officer, you're not merely managing financial transactions; you're also building relationships with clients, hence, demonstrating your professionalism, communication skills, and credibility during the initial meeting is of utmost importance.

- Dress professionally to show you take the position seriously.

- Arrive on time for the interview to demonstrate punctuality.

- Display a good understanding of the financial industry and loan processes during the interview.

- Show a strong ability to analyze financial data and assess customer creditworthiness.

- Demonstrate excellent customer service skills, as this is essential for interacting with loan applicants.

- Express your ability to work under pressure, especially in meeting sales targets.

- Show good sales skills, a key requirement for a loan officer position.

- Exhibit strong communication skills, both written and verbal.

- Show your willingness to learn and adapt to new banking systems and technologies.

- Express familiarity with loan underwriting and processing procedures.

- Show your ability to work as part of a team, as loan officers often collaborate with underwriters and loan processors.

- Demonstrate your ability to comply with banking regulations and guidelines.

- Show a keen eye for detail as you'll be required to handle paperwork and contracts.

- Display confidence and a positive attitude throughout the interview.

- Show your ability to handle rejection and work towards achieving set goals.

- Prepare relevant questions to ask at the end of the interview, this shows your interest in the role and the company.

- Use real-life examples to answer behavioral interview questions.

- Display a good understanding of risk management, as a key part of the loan officer's role involves assessing the risk of lending to different applicants.

- Mention any relevant certifications, licenses, or training you have in the field.

Understanding the Company: A Key Step in Preparing for Your Loan Officer Interview

Having a comprehensive understanding of the company you're interviewing with is vital to your success as a candidate. This knowledge not only demonstrates your genuine interest and initiative but also provides you with the opportunity to effectively align your skills, experiences, and aspirations with the company's mission and vision. By thoroughly researching the company, you're able to eloquently articulate how you can contribute to their goals and future growth. Moreover, this insight aids in formulating thoughtful questions and providing tailored responses during the interview. Embrace this process as an enriching journey that enhances your professional outlook and propels you one step closer to your desired career path.

Honing Your CV: The Key to Nailing Your Loan Officer Job Interview

A well-crafted CV is the gateway to your dream job; it's the first impression potential employers have of you. In the case of a Loan Officer position, it's crucial your CV effectively showcases your skills, experience, and qualifications in the banking and finance sector. A tailored CV not only increases your chances of getting an interview, but also prepares you to discuss your professional background during the interview process.

The structure of your CV should begin with your contact details at the top. Make sure to include your full name, email address, phone number, and LinkedIn profile if you have one. Here are some essential elements to include in your CV:

- Professional Profile: This should be a concise summary of your professional persona. For a Loan Officer, it could highlight your expertise in assessing client’s creditworthiness, excellent interpersonal skills, and a strong understanding of financial laws and regulations.

- Professional Experience: This section should outline your career history with the most recent position first. Ensure you include job titles, employers, dates of employment, and a brief summary of duties and achievements.

For instance, as a Loan Officer, you might mention that you "Managed a loan portfolio of $5 million and increased loan approval rates by 20%."

- Skills: This section should include your abilities that are relevant to the role of a Loan Officer. You might list skills such as "Risk assessment," "Financial counseling," "Loan structuring," and "Customer service."

- Education: Include all relevant academic qualifications. As a Loan Officer, this might include a degree in Finance, Business Administration, or a related field. Also, any certifications such as Certified Loan Officer or Mortgage Loan Originator License should be included.

- Additional Sections: These can help you stand out and can include languages spoken, awards, or relevant interests.

For example, speaking another language is a valuable asset in diverse communities, or an interest in financial blogging might show your passion for your field.

Unleash your professional potential by crafting your standout Loan Officer resume using our intuitive resume builder here.

Navigating a Loan Officer Job Interview Without Prior Experience

Breaking into a new role such as a Loan Officer without prior experience can be a daunting task, especially when it comes to the job interview. However, with the right preparation, you can confidently tackle any questions thrown your way. Below is a guide full of easy-to-use tips to help you prepare for a job interview for a Loan Officer position, even if you've never held the role before.

- Research Thoroughly: Start with understanding the role of a loan officer, the responsibilities, necessary skills, and common challenges faced in the role. You can find this information in job descriptions, online articles, and forums.

- Understand the Industry: Learn about the financial industry, its trends, and how loan officers contribute to the industry. This will show that you are interested in the field and are willing to learn.

- Highlight Relevant Skills: Even if you don't have direct experience, you may have transferable skills. These could include customer service, sales skills, analytical abilities, and problem-solving. Give concrete examples of how you have used these skills in your previous roles or experiences.

- Learn Basic Financial Concepts: Understand basic financial and lending concepts such as interest rates, credit scores, collateral, and mortgage. This will demonstrate that you are capable of learning the technical aspects of the job.

- Demonstrate People Skills: Being a loan officer often involves dealing with customers, so emphasize your communication, empathy, and negotiation skills.

- Show your Willingness to Learn: Be upfront about your lack of experience but express your enthusiasm for the role and eagerness to learn. You can also mention any steps you have taken to self-learn, like online courses or certifications.

- Practice Commonly Asked Questions: Look up common interview questions for loan officers and practice your answers. This can help you feel more confident and prepared during the actual interview.

- Know the Company: Research the company’s values, mission, and culture. Show how you align with these and can contribute positively to the company.

- Dress Professionally: First impressions matter. Dress professionally for your interview to show that you are serious about the role.

- Follow Up: After the interview, send a thank you note to the interviewer expressing your gratitude for the opportunity and restating your interest in the role. This leaves a positive impression and keeps you on their radar.

Honing and Showcasing Your Soft and Hard Skills for a Loan Officer Job Interview

When interviewing for the position of a Loan Officer, it is essential to demonstrate both your soft and hard skills. Soft skills, such as communication, empathy, and problem-solving, are critical because you will be dealing with diverse clients, guiding them through complex financial processes. Hard skills such as knowledge of lending procedures, understanding of financial software, and ability to analyze financial data are equally important because they are directly related to the tasks you will have to perform. Recruiters are looking for candidates who can balance these soft and hard skills, showing not only their technical proficiency in handling loan processes but also their ability to build relationships with clients, understanding their needs, and providing excellent customer service.

Below, we will showcase a comprehensive list of both soft and hard skills, which are highly beneficial in enhancing your job interview performance for the position of a Loan Officer.

Soft Skills:

- Communication Skills: As a Loan Officer, the ability to clearly and effectively communicate with clients, lenders, and team members is crucial. This includes being able to explain complex financial information in a way that is easy to understand.

- Customer Service: Exceptional customer service skills are crucial in maintaining and developing client relationships. This includes being patient, responsive, and empathetic to the needs of the clients.

- Decision-Making: The ability to make sound decisions quickly and efficiently is essential in this role. This includes assessing risk and making informed decisions based on the facts at hand.

- Problem-Solving Skills: This involves being able to identify and resolve problems efficiently. This includes finding innovative solutions to unique client needs.

- Negotiation Skills: The ability to negotiate terms that satisfy both the client and the bank is crucial. This includes being persuasive and diplomatic in negotiations.

Hard Skills:

- Financial Analysis: As a Loan Officer, you must be able to analyze a client's financial data and determine their ability to repay a loan. This includes understanding and interpreting balance sheets, income statements, and credit reports.

- Knowledge of Lending Laws: You need to understand and stay up-to-date with federal and state laws related to lending. This includes fair lending laws, truth in lending laws, and privacy laws.

- Proficiency in Loan Origination Software: Proficiency in using loan origination systems such as Encompass or Calyx Point is required to process loans efficiently.

- Risk Assessment Skills: The ability to assess the risk involved in lending money to clients is crucial. This includes evaluating the client's creditworthiness and collateral value.

- Understanding of Loan Products: A strong understanding of various loan products and their terms is essential. This includes understanding the differences between fixed-rate, adjustable-rate, interest-only, and balloon payment loans.

Selecting the Appropriate Attire for a Loan Officer Job Interview

In conclusion, dressing appropriately for a job interview is a significant factor in creating a positive impression. For a Loan Officer position, the attire should reflect professionalism, credibility, and attention to detail. Here are some key points and suggestions to help you nail the perfect look:

- Opt for a business formal attire: A suit, either navy, black or dark grey, is often the best choice. Pair it with a crisp, collared shirt in a conservative color like white or light blue.

- Choose your shoes wisely: Wear polished leather shoes in black or brown. Make sure they are clean and in good condition.

- Pay attention to your grooming: Ensure that your hair is neat and styled conservatively. For men, facial hair should be well-groomed or clean shaven.

- Accessories should be minimal and classic: For women, a small pair of earrings or a delicate necklace is acceptable. For men, a classic wristwatch can add a professional touch.

- Avoid strong fragrances: Some people are sensitive to certain scents. It's best to keep your perfume or cologne subtle, or skip it altogether.

- Carry a professional bag: A briefcase or a neat, structured handbag in a neutral color like black or brown is ideal. Ensure it's clean and in good condition.

- Don't neglect your nails: Clean, well-manicured nails are a fundamental part of personal grooming. Avoid bright or unconventional nail colors.

Honing Your Skills for the Second Job Interview as a Loan Officer

The second job interview for the position of Loan Officer is generally a more in-depth conversation that builds upon the first interview. It typically involves more specific questions related to the industry and the role, and may include meeting with upper management or other key team members. To prepare, candidates should thoroughly research the company's lending practices, the specific loan products they offer, and any recent news or trends in the financial sector. It's also beneficial to review any feedback or notes from the first interview to improve upon or clarify any points. Practice answering more complex interview questions, and prepare some thoughtful questions to ask the interviewers to demonstrate your interest in the role and the company.

Enhancing Your Loan Officer Application: Value-Adding Elements for Your Job Interview

Below we present a list of additional positive elements to mention during a second job interview for the Loan Officer position:

- Proven track record of successful loan processing: Discuss your previous experiences where you've successfully processed and closed loans. This could include times when you've helped clients with complex financial situations or worked within tight deadlines.

- Strong analytical skills: Emphasize your ability to analyze complex financial documents and determine a potential borrower's creditworthiness.

- Excellent interpersonal skills: As a loan officer, you'll be working closely with clients. Highlight any experiences that demonstrate your ability to build and maintain strong relationships.

- Knowledge of the industry: Discuss your understanding of the financial industry, including current trends and regulations. This will show that you're able to provide informed advice to clients.

- Ability to work under pressure: In this role, you'll often need to meet tight deadlines. Discuss any experiences where you've successfully worked under pressure.

- Sales skills: As a loan officer, you'll also need to sell your company's products and services. Discuss any sales experience you have, particularly within the financial industry.

- Detail-oriented: Highlight your ability to pay attention to the details when reviewing loan applications.

- Technological skills: In today's digital world, being able to navigate and utilize various software systems and platforms is crucial. Mention any relevant technological skills you have.

- Career goals: Discuss your long-term career goals within the finance industry. This will show the company that you're committed and ambitious.

- Willingness to continue learning: In the ever-changing finance industry, it's important to stay up-to-date with new trends and regulations. Mention any additional courses or certifications you're planning to take.

- Team player: Mention your ability to work well in a team. Give examples of how you've successfully worked in a team in the past, as this role may require you to work closely with others.

- Multitasking skills: Being a loan officer often requires juggling multiple tasks at once. Highlight your ability to effectively multitask without compromising on the quality of your work.

- Problem-solving skills: Discuss your ability to think critically and solve problems, which is crucial when determining the best loan options for clients.