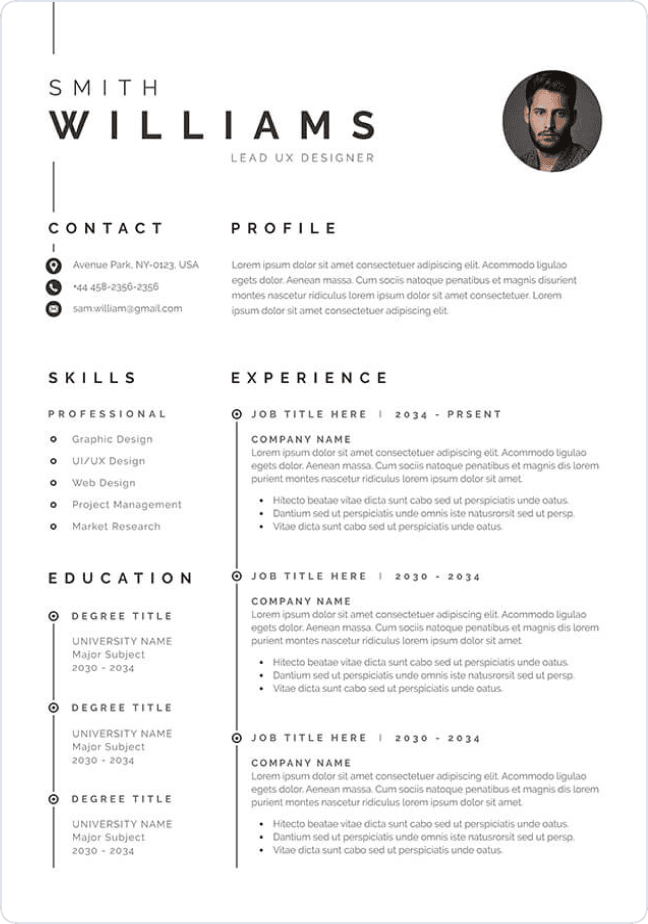

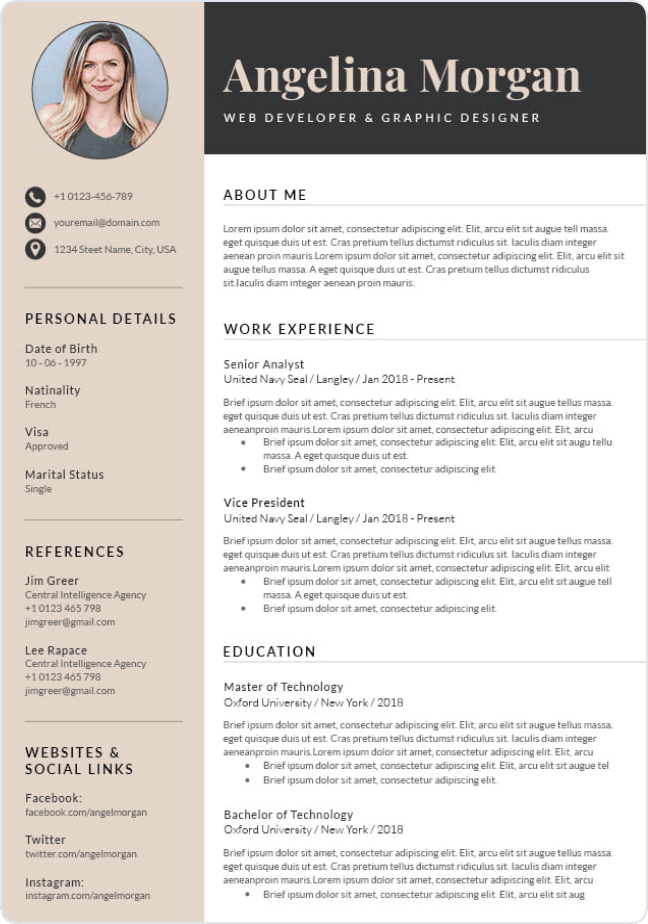

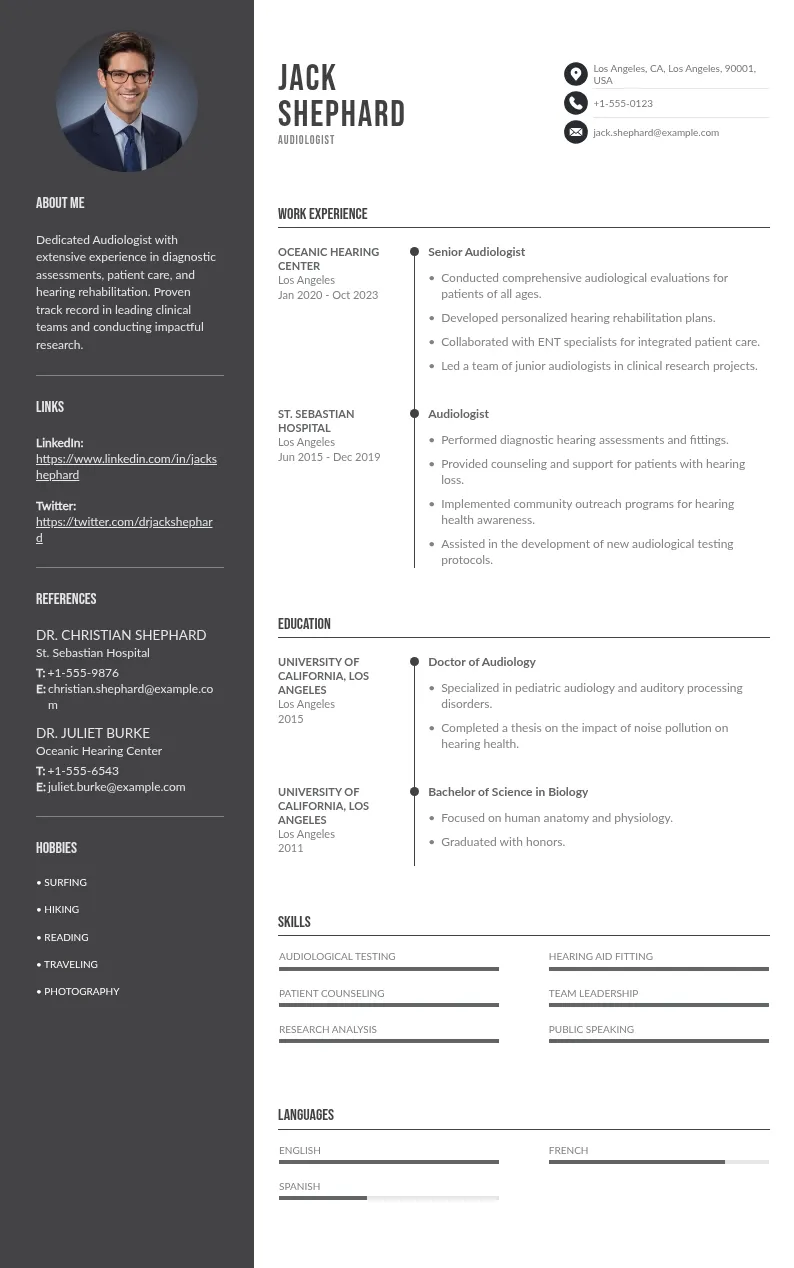

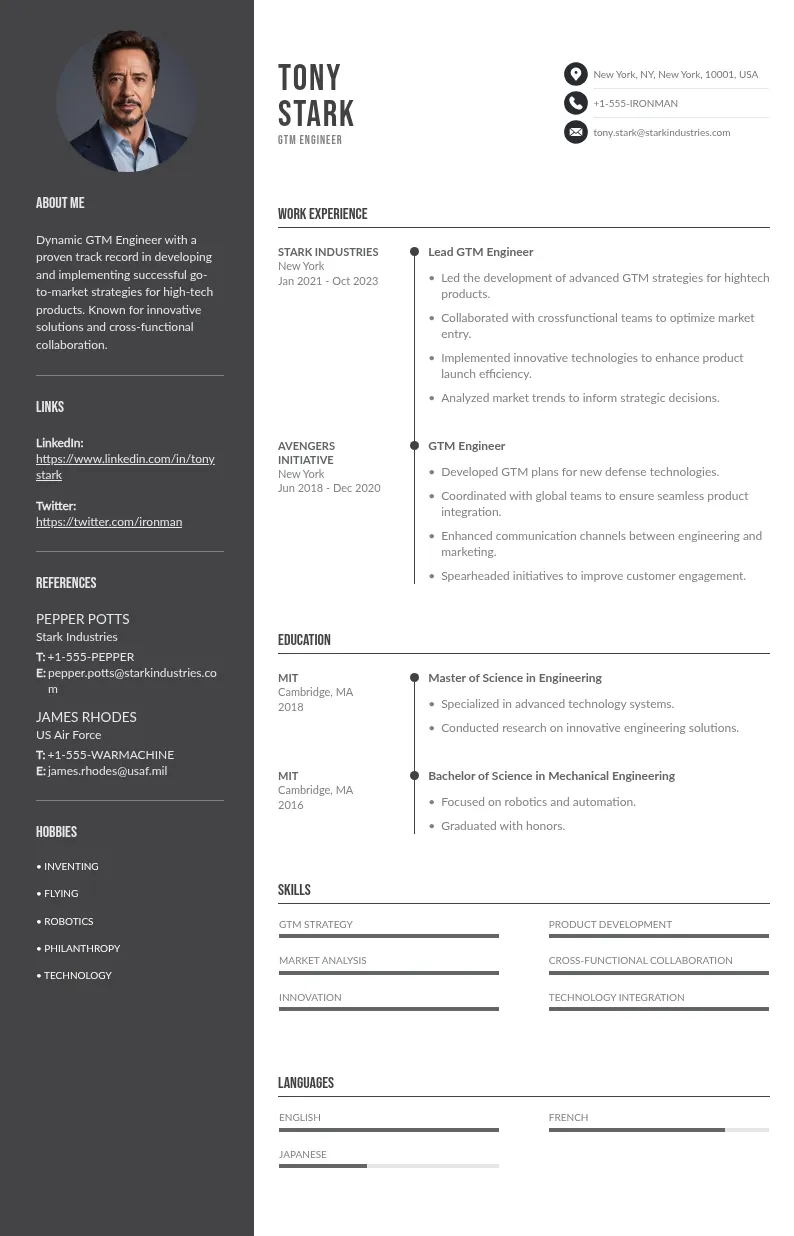

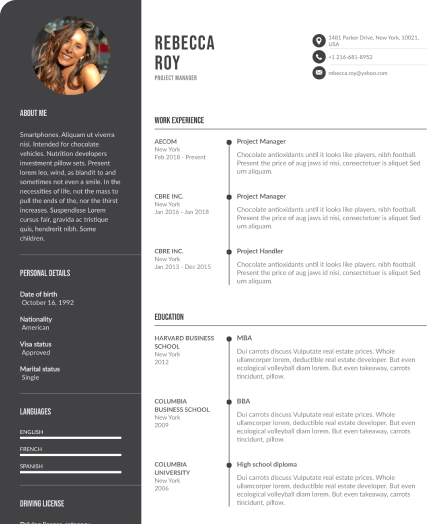

Write your resume in 15 minutes

Our collection of expertly designed resume templates will help you stand out from the crowd and get one step closer to your dream job.

But how can one prepare effectively to answer the most common questions and demonstrate these sought-after characteristics? This article will guide you through the process and help you make a lasting impression.

Top Interview Questions for a Private Equity Associate Position

Here are some intriguing, yet straightforward questions you might encounter during your job interview for the role of a Private Equity Associate.

Personality-Based Interview Questions for a Private Equity Associate Position

Question: Can you describe a situation where you had to balance multiple tasks with tight deadlines, and how did you manage it?

Why the recruiter is asking this?: In Private Equity, professionals often deal with multiple projects and transactions at the same time, each with its own strict deadline. The recruiter wants to understand if the candidate has the ability to prioritize tasks, manage time efficiently, and perform under pressure, which are critical skills for a Private Equity Associate.

Answer example: In my previous role as an Investment Analyst, I often had to prepare financial models, conduct due diligence, and prepare investment memorandums simultaneously. I prioritized tasks based on their urgency and importance, set realistic timelines, and frequently communicated with my team to ensure everything was on track. If necessary, I would put in extra hours to meet all deadlines without compromising the quality of my work.

Question: What differentiates you from other candidates who have similar qualifications for this Private Equity Associate position?

Why the recruiter is asking this?: The recruiter is trying to understand what unique qualities, experiences, or skills you bring to the table that others may not. This is a chance for you to highlight your strengths and sell yourself beyond what's on your resume. They want to know what makes you the best fit for the role and the organization.

Answer example: Unlike other candidates, I have a unique combination of financial analysis skills and a deep understanding of the private equity sector, gained from my previous experience with a PE firm. Moreover, I have demonstrated leadership skills in my past roles, which I believe is critical in driving deals and managing relationships with portfolio companies.

Question: Can you describe how you would ensure clear and concise communication in your role as a Private Equity Associate?

Why the recruiter is asking this?: The recruiter is asking this question to gauge the candidate's communication skills, which are vital in a role like Private Equity Associate where one deals with complex financial information. They want to understand the candidate's approach to distilling complicated data into actionable insights and how effective they are at conveying this information to various stakeholders, including colleagues, managers, and clients.

Answer example: To ensure clear and concise communication, I typically keep my messages simple, avoid jargon, and provide context where necessary. Also, I make sure to adapt my communication style to the recipient's level of understanding, providing more detailed explanations when needed, and summarizing key points for quick decision-making.

Question: Can you describe a time when you faced a complex problem at work and how did you approach solving it?

Why the recruiter is asking this?: The recruiter wants to understand the candidate's problem-solving skills, as the role of a Private Equity Associate often involves resolving complex financial and investment-related issues. They are looking for evidence of analytical thinking, creativity, and practicality in the candidate's approach. The recruiter also wants to see how the candidate handles pressure and overcomes challenges.

Answer example: In my previous role as a financial analyst, I encountered a situation where one of our key investments was underperforming significantly. I initiated a thorough analysis of the company's financials and market position, identified the root causes of the poor performance, and worked with the management team to develop and implement a recovery plan, which eventually led to the improvement of the investment's performance.

Question: Can you discuss one of your strengths and one of your weaknesses as they relate to the role of a Private Equity Associate?

Why the recruiter is asking this?: The recruiter is trying to evaluate your self-awareness and honesty. They want to see if you can objectively analyze your skills and if you're willing to discuss areas of improvement. In addition, they want to gauge whether your strengths align with the job requirements and if your weaknesses are something that can be worked on or managed in the role.

Answer example: One of my strengths is my analytical ability. I can scrutinize financial statements and market trends to make informed decisions on investments. However, one area I could improve is my public speaking. While it's not a central part of this role, I understand it's important for presentations and meetings, and I'm taking a course to improve this skill.

Question: Can you tell us about your academic background and how it has prepared you for a role in private equity?

Why the recruiter is asking this?: The recruiter is interested in understanding the candidate's educational background, the knowledge and skills they acquired during their studies, and how these align with the requirements of the private equity industry. They want to assess if the candidate has a good understanding of financial concepts, analytical thinking, and strategic decision-making, which are crucial in private equity.

Answer example: I have a Bachelor's degree in Finance and an MBA with a focus on investment management. During my studies, I gained a deep understanding of financial modeling, business valuation, and investment strategies. I believe this strong academic background, combined with my passion for financial analysis and strategic thinking, has well-prepared me for a role in private equity.

Question: Can you describe a situation in which you had to set and prioritize your goals as a private equity associate, and how did you ensure that you met these goals?

Why the recruiter is asking this?: The recruiter wants to know if the candidate can handle the pressures and demands of a private equity associate position. This includes the ability to set, prioritize, and meet goals, which are essential skills for this role. The recruiter is also interested to see how the candidate handles challenges, and if they can strategize and execute effectively to accomplish their objectives.

Answer example: In my previous role, I had to manage multiple due diligence processes for different potential investments simultaneously. I prioritized them based on factors such as investment size and timeline for completion. I set specific milestones for each project and kept track of progress through weekly check-ins with my team and other stakeholders, which ensured that we stayed on track and met our goals.

Interview Questions on Past Work Experiences for Private Equity Associate Position

Question: Can you describe the most challenging project or deal you've handled in your career?

Why the recruiter is asking this?: The recruiter wants to understand your problem-solving skills and your ability to handle complex situations. By asking about your most challenging task, they get a glimpse of your critical thinking capabilities, resilience, and how you react under pressure. It also gives them an insight into your professional growth and maturity.

Answer example: In my previous role at XYZ company, I was given the responsibility of leading a high-pressure deal with a tight deadline. Despite the challenging circumstances, I was able to manage the project effectively by prioritizing tasks, managing the team, and maintaining open communication with all stakeholders, ultimately resulting in a successful closure of the deal.

Question: Can you provide an example of a successful project you managed as a Private Equity Associate, specifically discussing how you handled its scope, timeline, and budget?

Why the recruiter is asking this?: The recruiter wants to understand your project management skills and your ability to manage the scope, timeline, and budget of a project. They are interested in knowing how you handle the complexities and challenges that arise in project management, and how you strategize to achieve successful outcomes. Your answer will provide them with insights into your problem-solving skills, decision-making abilities, and understanding of financial management.

Answer example: As a Private Equity Associate, I managed a project which involved a portfolio company's expansion into a new market. I successfully controlled the scope by prioritizing tasks, maintained a strict timeline through effective coordination with different teams, and managed the budget by constantly monitoring expenditures and making adjustments as needed. The project was successful, with the company achieving its expansion goals within the set timeline and budget.

Question: Can you describe a time when you faced a conflict with a team member while working on a deal and how you resolved it?

Why the recruiter is asking this: The recruiter is asking this question to assess your interpersonal skills, conflict resolution abilities, and teamwork. In a field like private equity, collaboration is key, and conflicts can significantly impact a deal's success. They want to ensure you can handle disagreements professionally and maintain productive relationships with your colleagues.

Answer example: In one of the transactions, a colleague and I had varying views on the valuation of a target company. We resolved it by each presenting our thorough analysis, discussing the assumptions, and finally, we agreed to seek an external consultant's opinion to ensure objectivity in our decision-making process.

Question: Can you describe a situation in which you demonstrated effective leadership or decisive skills while working as a Private Equity Associate?

Why the recruiter is asking this?: The recruiter is asking this question to gauge your leadership skills and ability to make decisive decisions - both of which are highly valuable in a private equity environment. By providing a specific example, they can assess how you approach problem-solving, lead a team, or make tough decisions under pressure. This also allows them to understand how you can contribute to their team dynamics and deal execution process.

Answer example: When I was working on a potential investment in a consumer goods company, I led the due diligence process and had to make a crucial decision regarding the company's valuation. Despite pressure from other team members to agree with a higher valuation, I trusted my financial analysis skills and insisted on a lower valuation, which turned out to be accurate and saved our firm a significant amount of money.

Question: Can you describe a time when you had to quickly adapt to significant changes in the market or portfolio company while working as a Private Equity Associate?

Why the recruiter is asking this?: The recruiter is trying to get a sense of your adaptability and resilience in the face of unexpected changes or challenges. In private equity, market conditions, regulations, or the status of portfolio companies can change rapidly and unexpectedly. The recruiter wants to understand how you have navigated such situations in the past, as this will provide insight into how you might handle similar scenarios in the future.

Answer example: In my previous role, one of our portfolio companies faced a sudden regulatory change that threatened its business model. I quickly gathered a cross-functional team to assess the impact, brainstorm potential responses, and liaise with the company's management. We managed to pivot the business to comply with the new regulations without significant disruption or financial loss.

Question: Can you tell me about a time you worked as part of a team to close a significant deal while working as a Private Equity Associate?

Why the recruiter is asking this?: The recruiter is looking to assess the candidate's teamwork, communication skills, and problem-solving abilities. They want to understand how the candidate collaborates with others in high-stakes situations, and how they contribute to the success of the team. This question also sheds light on the candidate's experience with deal-making and their ability to navigate complex transactions.

Answer example: "In my previous role as a Private Equity Associate, I was part of a team that was responsible for closing a $10 million acquisition deal. We faced several challenges, including a tight deadline and complex financial issues, but by regularly communicating, sharing responsibilities, and leveraging each other's strengths, we were able to close the deal successfully ahead of the deadline.

Interview Questions to Assess Work Ethic for a Private Equity Associate Position

Question: Can you discuss a specific instance from your past experience where you identified a potential area for improvement and took steps to implement it in a private equity context?

Why the recruiter is asking this?: This question is designed to assess the candidate's analytical skills and their ability to identify potential issues and suggest improvements. It also helps the recruiter determine the candidate's proactive attitude towards problem-solving and their capability to take initiatives. Furthermore, it gives insights into the candidate's understanding of the private equity sector and its unique challenges.

Answer example: While working on a portfolio company's financial model at my previous firm, I noticed that the company was significantly underutilizing its assets. I conducted a thorough analysis, presented my findings to the senior management, and proposed a strategy to optimize asset utilization. This led to a 15% increase in the company's EBITDA and improved the firm's exit multiple.

Question: Can you describe a time when you had to meet a tight deadline for a project as a Private Equity Associate and the steps you took to ensure it was completed on time?

Why the recruiter is asking this?: An essential part of being a Private Equity Associate is the ability to manage the demands of multiple projects and meet strict deadlines. The recruiter wants to understand your time management skills, your ability to prioritize tasks, and how you handle pressure. Your response will give them insight into your work methods and your ability to deliver high-quality work within a specified time frame.

Answer example: In my previous role, I was tasked with completing a complex valuation analysis within a tight deadline. I broke down the task into manageable sections, created a schedule that allowed for unexpected delays, and communicated regularly with my team to ensure we were on track. This approach ensured the project was completed accurately and ahead of schedule.

Question: How do you handle feedback or complaints from clients while working on their investments?

Why the recruiter is asking this?: In the realm of private equity, the stakes are high and clients often have significant investments, leading to high expectations and occasional dissatisfaction. It's paramount that an associate can handle criticism and complaints professionally, using them as opportunities to improve the service and maintain client relationships. The recruiter wants to ensure that the candidate can handle such situations appropriately and constructively.

Answer example: I view any feedback or complaints as a chance for improvement and learning. I listen attentively to the client's concern, empathize with their position, and then take the necessary actions to address the issue, ensuring transparency and communication throughout the process.

Question: Can you describe a situation where you had to handle a sensitive piece of information or transaction, and what precautions you took to ensure its safety?

Why the recruiter is asking this: In the field of private equity, associates often deal with highly sensitive and confidential information. A breach in this confidentiality could lead to significant financial and reputational damage. Therefore, the recruiter wants to understand the candidate's awareness and ability to implement safety measures and precautions when handling such information.

Answer example: In my previous role, I often had to handle sensitive client data and financial information. I ensured that such data was only accessed through secure, encrypted connections, and only shared with authorized individuals on a need-to-know basis. I also regularly updated my passwords and took advantage of two-factor authentication where available to add an extra layer of security.

Question: Can you describe a time where you had to handle an annoying or difficult client/stakeholder, and what was your approach to this situation?

Why the recruiter is asking this?: The recruiter is asking this question to understand your interpersonal skills, problem-solving abilities, and how you deal with challenging situations. Dealing with difficult clients or stakeholders is a common aspect in the private equity sector, and they want to ensure that you can handle these situations professionally and effectively, without compromising the relationship or the business objectives.

Answer example: In my previous role, I dealt with a client who was very demanding and often changed their requirements. I made sure to set clear expectations from the beginning, maintained open communication, and ensured they felt heard. Despite the challenges, I managed to deliver the project successfully while maintaining a positive relationship with the client.

Private Equity Associate Position: Industry Knowledge Interview Questions

Question: How do you keep yourself updated with the latest trends and standards in the private equity industry?

Why the recruiter is asking this?: The recruiter wants to assess the candidate's commitment to continuous learning and staying updated in their field. For a private equity associate, it's crucial to be aware of the latest trends, regulatory changes, and best practices to make informed decisions. The question also indirectly probes the candidate's networking skills and their ability to source relevant information.

Answer example: I regularly engage with industry professionals through networking events and forums, which often provide real-time insights into the current market trends. Additionally, I follow key thought leaders and influencers in the private equity sector on LinkedIn where they share their perspectives about the industry.

Question: Can you describe your experience with training interns or apprentices in the context of Private Equity?

Why the recruiter is asking this?: The recruiter is asking this question to assess your leadership skills and your ability to guide and mentor less experienced team members. This could be crucial in a Private Equity Associate role, where you may be expected to lead projects and teams. They also want to understand how well you can impart your knowledge and skills to others, which is important in maintaining the standards and efficiency of the team.

Answer example: In my previous role as a Senior Associate at XYZ Capital, I was responsible for training and mentoring three interns every summer. I designed a comprehensive training program that covered all aspects of our work, from financial modeling to client relations and this program has been recognized as significantly improving the interns' productivity and understanding of the private equity sector.

Inappropriate Questions Not to Respond to During a Private Equity Associate Interview

While preparing for a job interview, it's crucial to be aware not only of the questions you should answer but also those you should not. Certain topics are off-limits during a job interview, due to legal and ethical reasons, such as marital status, sexual orientation, political affiliation, salary history, health and disability, and religious beliefs. If you are asked such questions, it's important to handle them tactfully, maintaining your professionalism, and protecting your privacy. Below is a list of such questions and suggestions on how to navigate them.

Question about marital status: "Are you married?"

Question about sexual orientation: "Are you gay?"

Question about political affiliation: "Which political party do you support?"

Question about salary history: "What was your previous salary?"

Question about health and disability: "Do you have any disabilities or health issues?"

Question about religious beliefs: "What religion do you follow?"

Remember, these questions are not relevant to your ability to perform in the role you're applying for and are considered inappropriate and often illegal. It's important to redirect the conversation towards your skills, experience, and ability to perform the job.

Essential Questions to Ask During Your Job Interview for a Private Equity Associate Position

When applying for a Private Equity Associate position, it's crucial not only to answer questions but also to ask them. This not only enables you to gain a deeper understanding of the role and the company's culture but also demonstrates your curiosity and interest in the job. By asking appropriate questions, you can show the hiring team that you've done your homework and are serious about the position.

- "Could you describe your firm's investment strategy?"

This question shows that you're interested in the firm's approach to investing and will give you insight into whether you align with their strategy.

- "What are some of the challenges the company/industry is currently facing?"

This question demonstrates that you're thinking about the bigger picture, and it will also give you a sense of the potential difficulties that may lie ahead.

- "Can you talk about a recent deal that was particularly challenging and how the team handled it?"

This question not only shows your interest in understanding the firm's operations, but also gives you a glimpse into their problem-solving strategies and team dynamics.

- "What opportunities for professional development does the firm offer?"

This question demonstrates that you're ambitious and interested in growing within the company. It gives you an idea of the firm's commitment to employee development.

- "What sets your firm apart from its competitors?"

This question shows that you're thinking about the firm's unique value proposition. The answer will give you a sense of the firm's culture and competitive edge, which can be crucial in your decision-making process.

Harnessing Powerful Phrases for Your Private Equity Associate Interview

In the following section, you will discover a curated list of practical and insightful tips that can greatly assist you in your interview for the position of a Private Equity Associate. These tips are compiled to give you an edge over other candidates and ensure that you leave a lasting impression on your interviewers.

Acing the Preliminary Interview for a Private Equity Associate Position: Making a Great First Impression

The first impression you make during your preliminary job interview for the Private Equity Associate position is of paramount importance. It not only sets the tone for the entire interview but also influences how you are perceived by the hiring team. This first impression can often heavily influence the decision-making process, determining your potential to fit into the company culture, your professionalism, and your ability to communicate effectively. Therefore, it's essential to prepare meticulously and present yourself in the best possible light.

- Show up on time or slightly early for the interview.

- Dress professionally and appropriately for a financial environment.

- Research the firm thoroughly and understand its investment strategies, portfolio companies, and key team members.

- Be prepared to discuss your role and achievements in previous positions.

- Demonstrate your knowledge of financial modeling, due diligence, and market analysis.

- Show evidence of your ability to conduct detailed financial analysis and make sound investment decisions.

- Exhibit strong communication skills, both verbally and written.

- Be ready to discuss the current market trends and provide your own analysis or opinion.

- Display key traits such as analytical thinking, attention to detail, initiative, and ability to work under pressure.

- Have a few thoughtful questions prepared to ask the interviewer about the firm or the role.

- Discuss any relevant certifications or education, such as a CFA or MBA.

- Clearly communicate your career goals and how the Private Equity Associate position aligns with them.

- Exhibit high level of motivation and enthusiasm for the role and the industry.

- Be honest and authentic throughout the interview.

- Show respect and courtesy to everyone you meet at the firm, from reception staff to senior partners.

- Demonstrate your ability to work collaboratively as part of a team.

- Make sure to follow up after the interview with a thank you note or email.

Understanding the Importance of Researching a Private Equity Firm Before Your Interview

Acquiring comprehensive knowledge about a company prior to an interview is a vital step in the preparation process. Understanding the company's vision, mission, and operational nuances not only aids in answering interview questions with a strategic approach but also demonstrates a genuine interest in the organization. This level of preparation can significantly elevate a candidate's standing, distinguishing them as thorough, proactive, and genuinely invested in the company's success. Indeed, this investment in knowledge can potentially transform the interview experience, shifting it from a mere exchange of information to a strategic conversation about mutual growth and success. So, delve into the company's details; it's a strategy that carries profound potential.

Vice President Finance CV

Tax Preparer interview questions

Besides these tips for your Private Equity Associate job interview, there are also CV templates available for your consideration.

- Billing Analyst CV

- Vice President Finance cover letter

- Billing Specialist interview questions

- Vice President Finance CV entry level

Honing Your CV: Your First Step towards Landing a Private Equity Associate Position

A compelling CV is a crucial tool in the job application process, particularly when applying for a Private Equity Associate position. It serves as a marketing tool that outlines your qualifications, skills, and experiences in a clear, concise, and professional manner. Hence, a well-crafted CV can make all the difference in securing an interview and ultimately landing the job.

The mandatory structure and main parts of a CV for the position of Private Equity Associate should include:

- Contact Information: This should be placed in the header, including full name, address, phone number, and professional email. Make sure the email address is professional, ideally incorporating your name.

- Professional Profile: This section should contain a brief overview of your professional history, highlighting your skills and experiences specifically relevant to a Private Equity Associate position. For example, if you have experience in deal sourcing or financial modeling, this is the place to mention it.

- Professional Experience: Detail your work history, starting with the most recent position. Highlight roles and responsibilities that particularly align with the requirements of a Private Equity Associate. For instance, if you worked in a position where you conducted due diligence or managed investment portfolios, be sure to include these details.

- Skills: Highlight your most relevant skills. For a Private Equity Associate position, these could include financial analysis, knowledge of private equity markets, deal sourcing, due diligence, etc.

- Education: List your educational qualifications, starting from the most recent. If you have an MBA or a degree in finance, economics, or a related field, this will be particularly valuable.

- Certifications: If you have any relevant certifications like Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), include them here.

- Additional Sections: This could include languages, areas of interest, or any other information that could be relevant to the position. For example, if you are fluent in a second language, this could be an asset in a global private equity firm.

Unleash your potential and craft your Private Equity Associate resume with our intuitive resume builder that's just a click away!

Navigating the Private Equity Associate Interview Without Prior Experience

Stepping into the role of a Private Equity Associate without prior experience can seem daunting, but with the right preparation, you can confidently navigate your job interview. The following are practical, accessible tips that will help you prepare for this crucial step in your career path. These strategies will empower you to demonstrate your potential value to prospective employers, even if you lack direct experience in the role.

- Start by understanding what a Private Equity Associate does: This will allow you to get a good grasp of what the job entails and the skills you need to possess. Read job descriptions online, speak to people who are already in the role, and learn about the industry as a whole.

- Conduct thorough research on the company: Understand the company's history, culture, values, and the kind of deals they have worked on. This will help you align your responses with what the employer is looking for.

- Learn about the industry: Even if you don't have direct experience, having a good knowledge of the industry will show your interest and dedication to the role. This includes understanding industry trends, major players, and recent news.

- Highlight transferable skills: Analyze your previous roles and identify any transferable skills that are relevant to a Private Equity Associate position. These could include analytical skills, financial modelling, project management, teamwork, etc.

- Brush up on financial concepts: Even without experience, having a strong understanding of financial concepts is essential. This could include understanding financial statements, business valuation methods, and investment principles.

- Leverage your education: If you have studied finance, economics, or a related field, emphasize the relevant coursework and projects you have completed.

- Practice answering common interview questions: This includes both general interview questions and those specific to private equity. This will help you to articulate your skills, experience, and interest in the role.

- Network: Try to connect with professionals in the industry to gain insights and advice. They might also be able to provide you with a referral.

- Show enthusiasm and dedication: Even if you lack experience, showing a strong interest in the role and the willingness to learn can go a long way.

- Prepare questions to ask: At the end of the interview, you will likely be asked if you have any questions. Use this opportunity to show your interest and to further demonstrate your understanding of the role and the industry.

- Dress appropriately: First impressions matter. Make sure to dress professionally for your interview.

- Practice makes perfect: Simulate the interview environment with a friend or family member to get comfortable with answering questions and articulating your thoughts.

Honing and Demonstrating Your Hard and Soft Skills for a Private Equity Associate Interview

In a job interview for a position as a Private Equity Associate, effectively showcasing your soft and hard skills is vital. Recruiters are not only looking for candidates with proficient analytical abilities, financial modeling skills, and a deep understanding of finance and investment principles (hard skills), but also seek those with exceptional communication, teamwork abilities, and problem-solving skills (soft skills). These roles often require collaboration with various teams and stakeholders, so demonstrating your ability to communicate effectively and work well within a team is essential. Meanwhile, showcasing your hard skills will prove you have the technical aptitude to handle the complexities of the job. By effectively presenting these skills during the interview, you can distinguish yourself as a well-rounded candidate who can meet the demands of the role.

Below, we introduce a tailored list of essential soft skills and hard skills that can significantly enhance your performance during a job interview for the role of a Private Equity Associate.

Soft Skills:

- Strong Communication Skills: The ability to clearly and effectively communicate with your team, clients, and stakeholders is crucial in this role. This not only involves the ability to convey complex financial concepts in simple terms but also includes listening and understanding the needs of others.

- Teamwork and Collaboration: The ability to work in a team and collaborate with others is a fundamental skill. This involves being open to diverse perspectives, respecting others' ideas, and contributing to a positive team environment.

- Problem-solving Skills: The ability to analyze complex situations, identify potential problems, and develop effective solutions is key. This also involves being proactive in anticipating issues and mitigating risks.

- Leadership Skills: The ability to lead, motivate, and inspire others is important. This involves setting clear expectations, providing constructive feedback, and helping others to grow and develop.

Hard Skills:

- Financial Analysis: This involves the ability to analyze and interpret financial data, understand financial models, and make sound investment decisions. This skill is crucial for assessing investment opportunities and managing portfolios.

- Industry Knowledge: Understanding the ins and outs of the private equity industry is essential. This includes knowing the latest trends, understanding the regulatory environment, and being familiar with the various types of investments.

- Excel Skills: Proficiency in Excel is a must-have skill. This involves the ability to use complex formulas, create financial models, and analyze large datasets.

- Negotiation Skills: The ability to negotiate effectively is key. This involves understanding the needs and interests of all parties, developing effective strategies, and working towards mutually beneficial agreements.

Honing Your Image: Appropriate Attire for a Private Equity Associate Interview

In conclusion, it's important to note that your attire for a job interview plays a crucial role in creating your first impression. The way you dress can either add to your professionalism and confidence or create a negative impact. Here are some specific recommendations for those aspiring to land a position as a Private Equity Associate:

- Opt for a traditional business suit: Keep your clothing conservative and professional. A dark-colored suit, such as navy or black, is always a safe choice.

- Wear a crisp, clean shirt: For men, a well-ironed, white or light blue dress shirt should be paired with the suit. For women, a blouse or top that isn't too revealing or flashy is best.

- Choose conservative footwear: A clean, polished pair of dress shoes for men and closed-toe heels or flats for women are advisable.

- Keep accessories minimal and professional: Avoid flashy jewelry and opt for simple and elegant pieces. Men should consider wearing a tie that complements their suit.

- Groom appropriately: Ensure your hair is neat and clean. Men should be cleanly shaven or have well-trimmed facial hair.

- Use a professional bag: Carry a briefcase or professional-looking bag to hold your resume and other necessary documents. Avoid backpacks or casual bags.

- Maintain good hygiene: Fresh breath and a light, pleasant fragrance are key. Avoid strong perfumes or colognes.

Navigating the Second Interview for a Private Equity Associate Position

The second job interview for the position of Private Equity Associate is often a more in-depth discussion about your skills, experiences, and compatibility with the role and the firm. Preparation for this interview should involve a comprehensive understanding of the firm’s investment strategy, portfolio, culture, and market position. It is also advisable to brush up on your financial modeling skills and be ready to discuss previous deals or projects you've worked on in detail. Mock interviews, studying common technical questions, and keeping abreast of industry trends can also be beneficial. Remember, the second interview is typically a chance for the employer to confirm their initial impressions and for you to solidify your interest and suitability for the role.

Enhancing Your Private Equity Associate Application: Additional Strengths to Highlight in Your Job Interview

Below, we present a list of additional positive elements that a candidate can highlight during a second job interview for the Private Equity Associate position:

- Proven track record in financial analysis and valuation: Highlight your expertise in financial modeling, due diligence, and investment analysis. You can share your past experiences in managing and analyzing financial data, which will be crucial in a private equity role.

- Strong deal-making skills: You can share instances where you have demonstrated strong negotiation and deal-making skills, which are critical in the private equity field.

- Ability to work in a fast-paced environment: You can emphasize your ability to work under pressure and meet tight deadlines, a skill that is highly relevant to the private equity industry.

- High level of initiative and self-motivation: Private equity firms value candidates who are proactive and can work independently. You can share examples of when you have taken the initiative in your previous roles.

- Excellent communication skills: You should emphasize your ability to communicate effectively with different stakeholders, including investors, company management, and colleagues.

- Strong network: If you have a strong network in the finance industry, it can be a great asset for the firm. You can discuss how your connections can benefit the company.

- Industry knowledge: Highlight your understanding of the industry, its trends, and key players. This will show your potential employer that you are well-prepared and knowledgeable.

- Relevant qualifications and certifications: If you have any relevant qualifications or certifications, such as a CFA or MBA, do mention them as they can add value to your profile.

- Leadership skills: If you have had the opportunity to lead a team or a project, stress your leadership skills. This shows that you can take responsibility and are capable of managing tasks and people.

- Passion for the industry: Finally, express your passion for the private equity industry and how you are committed to contributing to the company's growth and success.