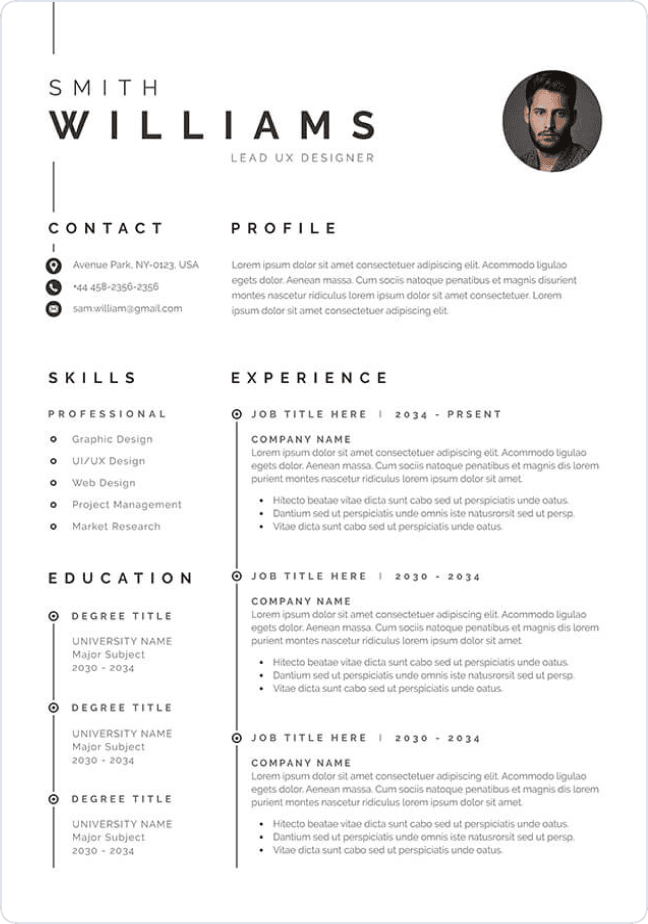

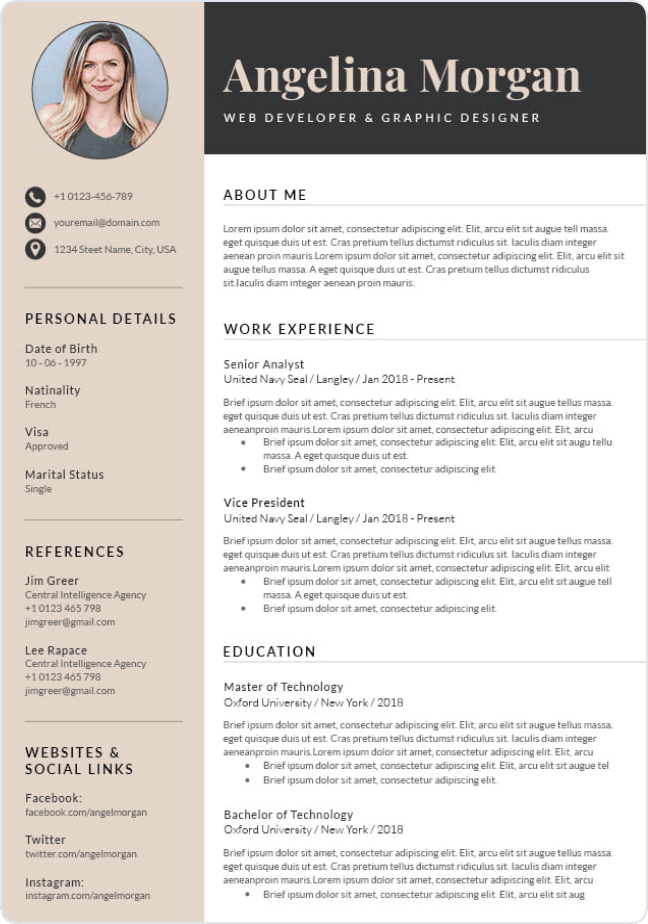

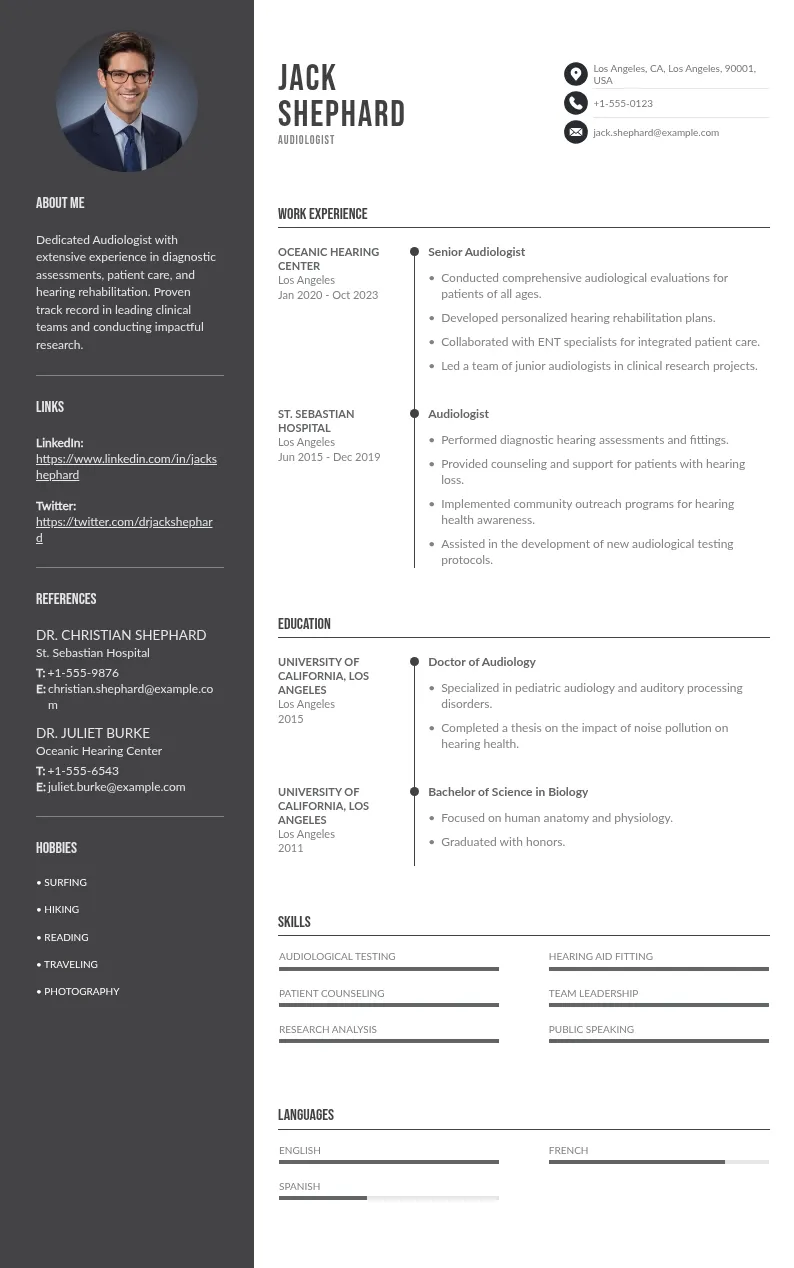

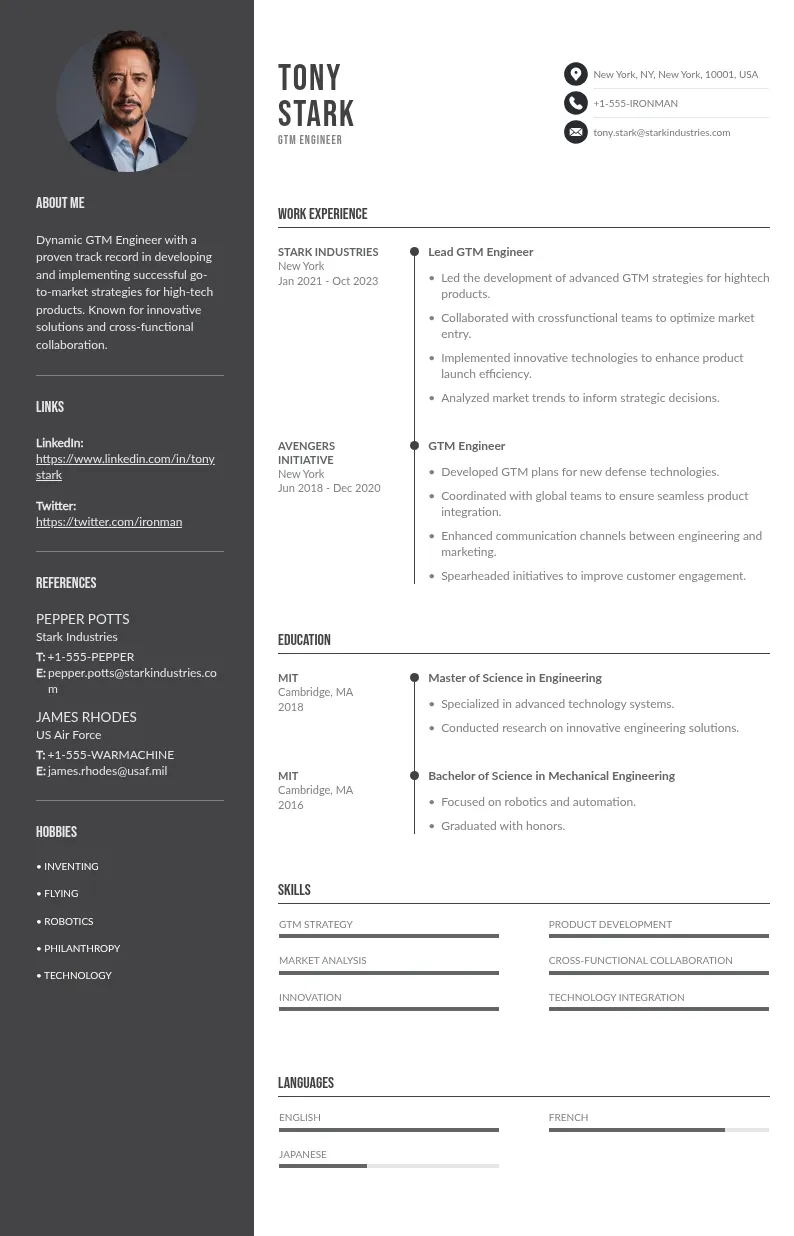

Write your resume in 15 minutes

Our collection of expertly designed resume templates will help you stand out from the crowd and get one step closer to your dream job.

In this article, we’ll break down the 15 most critical skills for financial planning positions. These are the skills needed to thrive in today’s competitive, fast-moving financial landscape.

15 Key Skills for Financial Planning Positions

To succeed in financial planning, you need more than number-crunching skills. Here are the 15 critical abilities that set top financial planning resumes apart.

1. Financial Analysis

At the heart of every financial plan lies a mass of complex financial data: income, liabilities, assets, investment returns, tax rates, inflation forecasts, you name it.

But it’s not enough to gather numbers. You need to interpret the numbers and analyze data. This means reading balance sheets, evaluating investment portfolios, and conducting detailed risk assessments. Through data analysis, you’re looking for patterns, red flags, and opportunities that others miss.

Why it matters:

Your ability to analyze financial data directly influences a client’s future decisions, and outcomes. Your analysis becomes their peace of mind.

2. Client Relationship Management

Financial planners are in the people business. Creating a solid financial plan is only one part of the job. Keeping your clients engaged, heard, and supported is what builds lasting relationships.

This involves active listening, regular check-ins, and genuine empathy, especially during life events like retirement, divorce, or a sudden inheritance. Trust is earned through care, clarity, and consistency.

Why it matters:

Long-term clients don’t just stick around, they refer others. Relationship-building fuels growth and reputation.

3. Regulatory Compliance

Financial planners work in one of the most highly regulated professions. From SEC rules to fiduciary standards set by the CFP Board, you’re responsible for playing by the book.

This means staying on top of changing regulations, understanding disclosure requirements, and never compromising client interests for personal gain. One misstep can lead to heavy penalties, or end your career.

Why it matters:

Your clients trust you with their life savings. That trust is built on ethical, transparent, and legally compliant practices.

4. Portfolio Management

You don’t have to be a hedge fund manager, but you do need to understand how markets work.

That includes knowing how to diversify a portfolio, evaluate risk tolerance, identify trends, and recommend suitable investment strategies and products, from ETFs to annuities. This goes hand in hand with project management skills, as each portfolio can be seen as a project. So, you must be able to adjust portfolios as client goals, market conditions, or tax laws change.

Why it matters:

Good investment advice and trend analysis can grow wealth and improve financial performance steadily. Bad advice can wipe it out. Clients depend on you to know the difference.

5. Tax Planning

Helping clients minimize tax liability is one of the most valuable services you can offer.

This includes understanding capital gains, tax-efficient withdrawals, deductions, charitable gifting strategies, and when to use a Roth vs. Traditional IRA. Even if you don’t prepare tax returns, your guidance can significantly impact after-tax income.

Why it matters:

Effective tax planning could save clients thousands (or even tens of thousands) over the years.

6. Technological Proficiency

Modern planners rely on software to model financial outcomes, track goals, manage portfolios, and communicate with clients.

Tools like eMoney, RightCapital, Morningstar, and CRMs like Redtail or Salesforce are part of your daily workflow. You also need to understand data security protocols to protect client information.

Why it matters:

Mastering tech boosts accuracy, saves time, and creates a more seamless experience for both you and your clients.

7. Communication Skills

You might know every line item on a client’s financial statement, but they don’t. And they shouldn’t have to.

The best planners can explain complex topics in plain English, using visuals like charts or analogies to make things click. You’re not just informing, you’re persuading, educating, and coaching.

Why it matters:

Clear, confident communication skills keep clients engaged and reassured, especially when markets get rough.

8. Adaptability and Commitment to Learning

Financial laws change. Products evolve. Economic conditions shift. So must you.

Top planners pursue continuing education, whether it’s earning a CFP®, CFA®, or ChFC®, reading industry news, attending conferences, or learning from client cases. Curiosity is a competitive advantage.

Why it matters:

Staying sharp and current protects your credibility and allows you to offer the best advice, every time.

9. Emotional Intelligence

Clients aren’t robots. They make impulsive decisions. They get scared, overconfident, or distracted by market noise.

A great financial planning expert understands the emotional side of money. You’ll coach clients through fear-driven selloffs, help them avoid lifestyle inflation, and encourage long-term thinking.

Why it matters:

You’re not just planning money. You’re helping clients manage their behavior and stay the course.

10. Goal-Based Planning

Every plan must answer one question: What does the client want their money to do?

From early retirement to good cash flow to leaving a legacy, your job is to reverse-engineer a financial strategy that aligns with those financial goals. That means creating realistic timelines and financial modeling, selecting the right financial products, and continually adjusting the plan as life changes.

Why it matters:

When plans are tied to real goals, clients stay engaged, and are more likely to stick to the strategy long-term.

11. Risk Management

Being a financial planning professional isn’t just about building wealth, it’s also about protecting it.

This includes evaluating insurance needs for life, disability, long-term care, property, and liability coverage. It's also about attention to detail and involves identifying hidden risks in portfolios or business operations that could derail progress, and including it in financial reports.

Why it matters:

You’re the safety net architect. Proper risk planning prevents devastating financial setbacks.

12. Retirement Planning Expertise

Retirement is one of the biggest goals for most clients, and one of the most complex.

Planners must understand Social Security strategies, pension options, required minimum distributions (RMDs), decumulation strategies, and how to avoid running out of money.

Why it matters:

You’re helping clients prepare for decades without a paycheck. That requires great precision and foresight, along with excellent ability to analyze financial statements.

13. Estate Planning Knowledge

While you’re not an attorney, you should be fluent in estate basics.

That includes understanding wills, trusts, powers of attorney, healthcare directives, and beneficiary designations. You’ll also help coordinate with estate lawyers to ensure the financial side aligns with legal wishes.

Why it matters:

Good estate planning preserves wealth across generations, and prevents costly, painful legal battles.

14. Organizational Skills

You’ll juggle dozens of clients, track hundreds of goals, stay compliant with legal requirements, and keep up with market news.

This requires airtight organization: calendars, task lists, file management, and prioritization. Planners who stay organized are better prepared, more responsive, and far less stressed.

Why it matters:

Clients notice when you're prepared, and when you're not. Time management keeps everything running smoothly.

15. Business Development and Marketing

Especially for independent planners, growth doesn’t happen on its own.

You’ll need to learn how to network, market your services, use social media, and perhaps even speak publicly. Understanding how to package your expertise and generate leads is a valuable skill, not just for your firm but for your career longevity.

Why it matters:

You can’t help people if they don’t know you exist. Smart marketing builds your client base, and your impact.

How to Start Developing These Financial Planning Skills

No one becomes a top financial planner overnight. But the good news? Every skill on this list is learnable. Whether you're just getting started or looking to level up, here’s how to begin building the abilities that matter most.

1. Earn Professional Certifications

If you're serious about financial planning, start with formal credentials. Programs like the CFP® (Certified Financial Planner), CFA® (Chartered Financial Analyst), or ChFC® (Chartered Financial Consultant) give you the technical foundation and ethical frameworks needed in this field. These certifications also boost credibility, and open more doors professionally.

2. Learn by Doing

Knowledge is important, but real growth happens through experience. If you’re working in finance, ask to observe client meetings or collaborate on portfolio reviews. Look for hands-on projects that stretch your comfort zone. You’ll learn more by applying what you know in real-world scenarios than you ever will in a textbook.

3. Build Soft Skills on Purpose

Technical skills get you in the door, but soft skills build trust. Practice active listening, clear communication, and empathy in every interaction. Take a public speaking class or join a Toastmasters group. Learn to explain complex ideas without using jargon. These are people skills, and they matter just as much as math.

4. Make Learning a Habit

Great planners never stop learning. Subscribe to industry blogs and financial newsletters. Attend webinars, conferences, or local workshops. Even short online courses can sharpen your knowledge and give you an edge. Every client interaction is a chance to reflect and improve. Stay curious, and stay ahead.

5. Focus on Progress, Not Perfection

You don’t need to master everything all at once. In fact, you can’t. Start with one or two skill areas and build from there. Track your growth, seek feedback, and keep challenging yourself. Consistent, steady improvement is how good planners become great ones.

Final Thoughts

Financial planning is all about people with big dreams, everyday worries, and stories that shape how they think about money. At its core, this career is about guiding those people through some of life’s most important decisions.

Sure, you’ll build portfolios. But more importantly, you’ll build trust, clarity, and the kind of confidence that helps clients sleep better at night.

Whether you're just getting started or ready to take your skills to the next level, these 15 must-have abilities will help you grow, stay relevant, and truly make a difference. Because in this field, it’s not enough to be competent, you need to be really exceptional. And that starts with mastering what matters most.