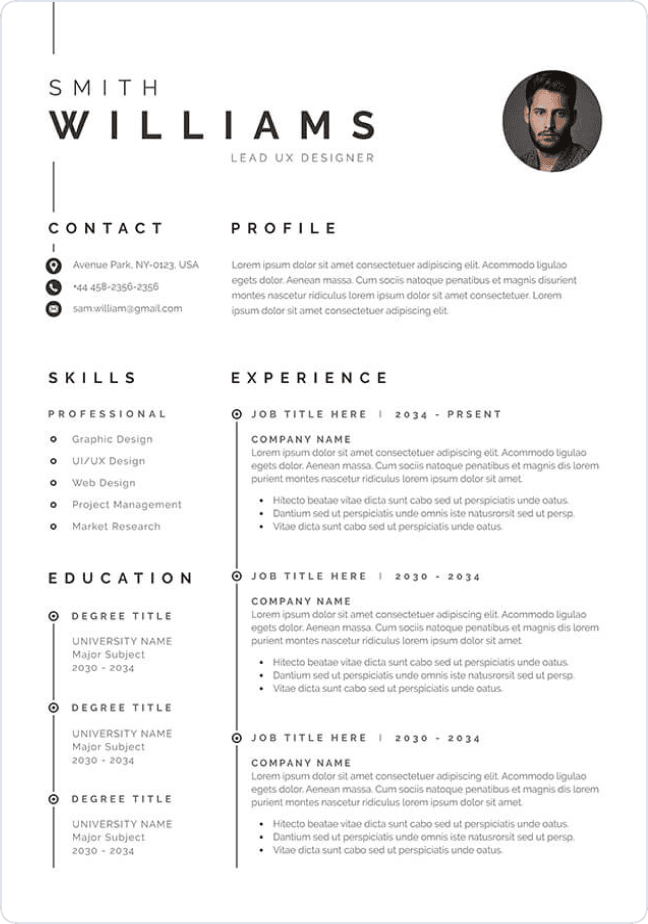

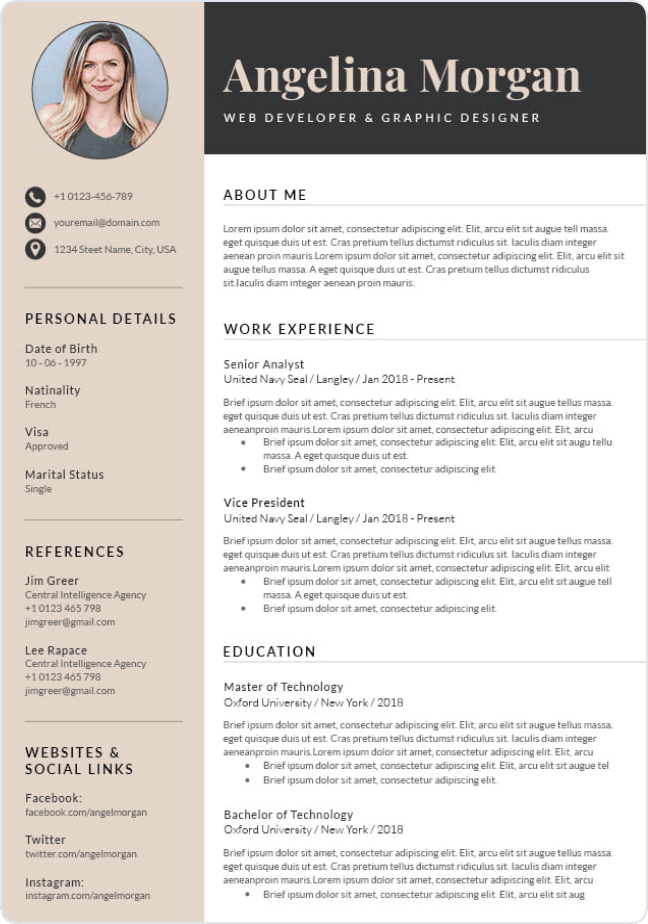

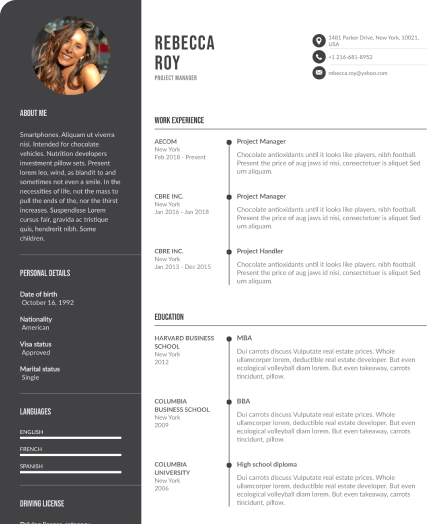

Write your resume in 15 minutes

Our collection of expertly designed resume templates will help you stand out from the crowd and get one step closer to your dream job.

How can one effectively prepare for the most commonly asked questions, and what strategies can be employed to demonstrate these characteristics during the interview?

Top Interview Questions for Bank Teller Job Applicants

Ready to ace your bank teller interview? Here's a sneak peek into some of the questions you might be asked.

Question: Can you describe a time when you had to manage multiple tasks at once and how you prioritized them?

Why the recruiter is asking this?: The role of a bank teller often involves multitasking between serving customers, handling cash transactions, and completing reports. Therefore, the recruiter is interested in knowing how you manage your time when faced with multiple responsibilities. Your answer will give them insight into your organizational skills and your ability to work under pressure.

Answer example: At my previous job, I often had to balance various tasks such as assisting customers, managing the cash drawer, and completing end-of-day reports. I prioritized tasks based on urgency and importance. For instance, serving customers was always my top priority because customer satisfaction is crucial. Meanwhile, I would manage the cash drawer in between customer interactions and complete reports during downtime, ensuring that all tasks were completed accurately and on time.

Question: Can you describe a situation where you had to deal with a difficult or annoying customer? How did you handle it?

Why the recruiter is asking this?: The recruiter asks this question to understand your problem-solving and interpersonal skills. They want to know how you handle pressure, maintain professionalism, and resolve conflicts. Your response can give insights into your customer service skills and ability to maintain the bank's reputation in difficult situations.

Answer example: In my previous role, there was a customer who was quite difficult and often caused scenes. I always remained calm and patient, listened to their concerns actively, and offered to help in any way I could. Over time, they became less hostile and more cooperative.

Question: Can you describe a situation where you identified and managed a potential safety risk in your past role?

Why the recruiter is asking this?: The recruiter is asking this question because safety is a critical concern in a bank setting. They want to know if the candidate is vigilant and proactive when it comes to identifying and managing safety risks. Their response can also give insight into their problem-solving skills and their ability to act quickly and responsibly in potentially dangerous situations.

Answer example: In my previous role at a retail bank, I noticed a customer acting suspiciously near the ATM machine. Rather than ignore the situation, I discreetly informed my manager and suggested we monitor the CCTV. It turned out the customer was attempting to install a skimming device and thanks to our vigilance, we were able to prevent any fraud from occurring.

Question: Can you describe your experience with training interns or apprentices in a bank teller role?

Why the recruiter is asking this?: The recruiter wants to understand if you have had prior experience in training new hires, and how you approached it. This is important as it speaks to your leadership skills, your ability to transfer knowledge effectively, and your patience to deal with someone who is new to the role and may make mistakes.

Answer Example: Yes, at my previous job, I was responsible for training two new interns. This included teaching them our software system, customer service tactics, and proper cash handling procedures. I took a hands-on approach, allowing them to shadow me before letting them handle tasks on their own, providing feedback along the way.

Question: Can you describe a situation where you faced a significant challenge in your previous role, particularly as it related to banking, and how you handled it?

Why the recruiter is asking this?: The recruiter asks this question to gauge the candidate’s problem-solving skills, resilience, and ability to handle stress or pressure. They are interested in understanding how the candidate responds to difficult situations, and if they have the capability to learn and grow from these experiences. It also provides insight into the candidate's level of responsibility and capability in their previous role.

Answer example: In my previous role as a bank teller, I was faced with a situation where a customer was adamant about withdrawing more money than what was in their account. I calmly explained bank policies and suggested alternative solutions like overdraft protection. I believe it's important to handle challenging situations with a customer-centric approach while adhering to bank rules.

Question: Why should we choose you over other applicants who are equally qualified for this Bank Teller position?

Why the recruiter is asking this?: The recruiter is asking this question to evaluate the unique skills or experiences that set you apart from other candidates. It is not just about comparing qualifications, but understanding your self-awareness, confidence, and ability to communicate your value. They want to see how you can bring something different to the role that others can't.

Answer example: Unlike other candidates, I have extensive experience in customer service from working in the hospitality industry before transitioning to banking. This background has equipped me with exceptional interpersonal skills and a high level of patience when dealing with customers, which I believe is crucial for a Bank Teller role.

Question: Can you explain how your educational background has prepared you for the role of a Bank Teller?

Why the recruiter is asking this?: The recruiter wants to understand how your academic experiences align with the duties and responsibilities of a Bank Teller. They are interested in knowing if you have gained any knowledge or skills from your education that will be beneficial for the job. This could be related to mathematics, finance, customer service, or any other relevant areas.

Answer example: During my studies in Business Administration, I took classes in Finance, Accounting, and Customer Service. These courses gave me a good understanding of financial systems and also taught me the importance of customer satisfaction. I believe this knowledge, coupled with my natural attention to detail, will help me succeed as a Bank Teller.

Question: Can you describe a situation where you had to overcome a weakness to successfully perform your duties, particularly in a bank teller role?

Why the recruiter is asking this?: The recruiter asks this question to understand how self-aware you are about your weaknesses and your problem-solving skills. They want to know if you can identify your weaknesses, take steps to address them, and how you handle challenges or setbacks in a banking environment. This would also demonstrate your ability to learn and grow from experiences.

Answer example: In my previous role as a bank teller, I realized that I struggled with multitasking during peak hours. I took it upon myself to learn and apply time management strategies, such as prioritizing tasks and breaking them into smaller, manageable parts. This significantly improved my ability to handle multiple tasks effectively and efficiently.

Question: How do you keep yourself updated on the latest industry standards and practices for a Bank Teller?

Why the recruiter is asking this?: The recruiter wants to understand how proactive the candidate is in staying informed about the latest industry trends, regulations, and best practices. This is important as it demonstrates the candidate's commitment to their professional development and their ability to adapt to changes in the banking industry.

Answer example: I make it a point to regularly participate in banking related forums and discussion groups online where professionals share their experiences and insights. Additionally, I subscribe to financial news platforms to stay informed about the industry trends and changes in banking regulations.

Question: Can you share an example of when you had to collaborate with a team to meet a common goal while working as a Bank Teller?

Why the recruiter is asking this?: The interviewer wants to understand how the candidate performs in a team setting. In a bank, it's crucial to work together with other tellers and staff members to ensure smooth operations and meet targets. This question allows the interviewer to gauge the candidate's teamwork skills, problem-solving abilities, and how they deal with challenges in a team environment.

Answer example: Sure, once we were short-staffed in our branch and had a high volume of customers. I coordinated with my fellow tellers to efficiently manage customer lines, while maintaining accuracy. We worked together, covered for each other during breaks, and successfully handled customer transactions without compromising on service quality.

Question: Can you describe a time when you faced a complex problem while dealing with a customer's transaction, and how did you handle it?

Why the recruiter is asking this?: As a bank teller, you will face numerous complex situations that require problem-solving abilities and a calm demeanor. The recruiter wants to understand your ability to handle such situations while maintaining the bank's policies and the customer's satisfaction. Your answer will give them insights into your problem-solving skills, decision-making process, and customer service abilities.

Answer example: Once, a customer wanted to withdraw a large amount of cash which we didn't have readily available. I apologized for the inconvenience, explained the situation to the customer, and suggested alternatives such as issuing a cashier's check or making a wire transfer. The customer appreciated my assistance and opted for a wire transfer.

Question: Can you describe a situation where you had to quickly adapt to a new policy or procedure in your role as a Bank Teller?

Why the recruiter is asking this?: The banking industry is an environment that is constantly evolving, with new policies and procedures being introduced regularly. Recruiters want to know that you are adaptable and can handle these changes efficiently. Your ability to adapt to change quickly is also a testament to your problem-solving skills and ability to handle stress, which are key for a Bank Teller role.

Answer example: In my previous role, a new procedure was introduced for handling cash deposits which required additional steps for verification. Despite the initial challenge, I quickly adapted to the new process, making sure to double-check all my work to prevent any errors. This led to a smoother transition for myself and my colleagues, and we were able to continue providing excellent service to our customers.

Question: Can you share an example of a situation where you demonstrated effective leadership or decisive skills while working as a Bank Teller?

Why the recruiter is asking this?: The recruiter is interested in understanding the candidate's leadership qualities and decision-making abilities, which are essential in the banking industry. This is important as it showcases the candidate's ability to handle critical situations, manage the team, and ensure smooth operations. Their response will also give insight into their problem-solving skills and how they handle pressure.

Answer example: In my previous role, I noticed a recurring issue where some transactions were taking longer than necessary due to a certain process. I took the initiative to identify the bottleneck, suggested a more efficient process, and communicated this to the management. After implementing the change, we saw a significant decrease in transaction times, leading to improved customer satisfaction.

Question: Can you describe a time when you received negative feedback or a complaint from a customer and how you handled it?

Why the recruiter is asking this?: The recruiter asks this question to understand how you react to criticism or complaints and how you resolve issues. As a Bank Teller, you will interact with customers daily and may face situations where they are not satisfied with the service. The ability to handle such situations professionally and maintain a high level of customer service is crucial.

Answer example: Once, a customer was upset because a transaction took longer than he expected. I apologized for the inconvenience, explained the reason for the delay, and assured him that we were doing our best to speed up the transaction. I believe it's important to listen, empathize, and assure the customer that their concerns are being addressed.

Question: Can you tell me about a time when you had to resolve a conflict within your team or with a colleague while working as a Bank Teller?

Why the recruiter is asking this?: The recruiter is asking this question to gauge your conflict resolution skills and your ability to maintain a harmonious work environment. It helps understand how you deal with difficult situations or disagreements at work. This is important for the role of a Bank Teller as it involves working closely with a team and dealing with customers, where conflicts may arise.

Answer example: In my previous role, a colleague and I disagreed about the handling of a complex transaction. Rather than letting the disagreement affect our work, we sat down and discussed the situation calmly, each explaining our perspective. We finally agreed on a solution that adhered to the bank's policy yet satisfied the customer's needs.

Question: Can you describe how you would ensure clear and concise communication with both customers and colleagues while working as a Bank Teller?

Why the recruiter is asking this?: Communication is key to the role of a Bank Teller, as they need to effectively convey important financial information to customers and collaborate with their team. They need to ensure that the communication is not only clear but also succinct to avoid any misunderstanding. This question is designed to assess the candidate's communication skills and their approach towards maintaining clarity and brevity in their professional interactions.

Answer example: I would ensure clear and concise communication by always listening attentively to the customer's needs or my colleague's input, and then responding in a straightforward manner. For complex banking procedures or products, I would break down the information into understandable parts, always making sure the recipient comprehends before moving on to the next point.

Question: Can you describe a time when you had to set and prioritize your own goals to meet a deadline, and how did you ensure you met these goals?

Why the recruiter is asking this?: A bank teller role requires a high level of efficiency and time management skills. The recruiter wants to know if the candidate can set realistic goals, prioritize them, and most importantly, meet them in the given timeframe. They are interested in understanding the candidate's approach to managing tasks and their sense of responsibility towards their work.

Answer example: Sure, when I was working at XYZ bank, I used to start my day by making a list of the tasks that needed to be completed. I prioritized them based on their deadlines, the effort required, and their importance. To ensure that I met these goals, I would monitor my progress throughout the day and stay organized with the help of task management tools.

Question: Can you provide an example of a project you managed successfully as a Bank Teller, particularly in terms of scope, timeline, and budget?

Why the recruiter is asking this?: The recruiter is trying to gauge your project management skills and understand how you handle tasks that require planning, coordination, and financial acumen. They want to see if you can deliver results within the given constraints and how well you can balance the different aspects of a project such as scope, timeline and budget.

Answer example: In my previous role as a Bank Teller, I managed the implementation of a new customer service protocol which aimed at reducing waiting times. I was responsible for training the team, monitoring progress, and staying within the allocated budget. Despite a tight timeline, I was able to successfully complete the project with a 20% reduction in average customer wait times and a 15% savings in the project budget.

Question: Can you describe a time when you had to meet a tight deadline as a Bank Teller and what strategies did you use to ensure you completed your tasks on time?

Why the recruiter is asking this?: The recruiter is asking this question to understand the candidate's time management skills and ability to work under pressure. As a Bank Teller, there are numerous tasks that need to be completed within a certain timeframe. The recruiter wants to know if the candidate can handle this stress, ensure accuracy and still deliver on time.

Answer example: In my previous role, I had to balance between serving customers and completing end-of-day reports. To ensure I met the deadline, I prioritized tasks and effectively managed my time. For instance, I would serve customers promptly during peak hours, then use the quieter periods to complete reports. This way, I was able to meet my deadlines without compromising service quality.

Question: Can you provide an example of a time when you identified an opportunity for improvement in your duties as a bank teller and how you implemented this change?

Why the recruiter is asking this?: The recruiter is interested in this because it demonstrates the candidate's initiative, problem-solving abilities, and capacity to contribute to continuous process improvement. As a bank teller, being able to identify areas for enhancement helps to increase efficiency and customer satisfaction. This question also allows the recruiter to assess the candidate's ability to implement changes effectively.

Answer example: In my previous role, I noticed that the process for handling foreign currency transactions was time-consuming and often caused delays for customers. I proposed a new procedure to my manager that involved using a dedicated workstation for these transactions, which was eventually implemented and resulted in reduced waiting times and improved customer service.

Inappropriate Questions to Avoid During a Bank Teller Job Interview

Job interviews are designed to evaluate a candidate's suitability for a specific role. However, some questions may infringe on the candidate's personal rights or privacy. While applying for a Bank Teller position, there are certain questions related to marital status, sexual orientation, political affiliation, salary history, health and disability, and religious beliefs that are inappropriate and should not be answered.

Here's a list of such questions and advice on how to handle them during the job interview:

Marital Status:

- Question: "Are you married? Do you have kids?"

- Advice: Politely, respond by saying, "I prefer to keep my personal life separate from my professional one. I assure you that my personal circumstances will not interfere with my job responsibilities."

Sexual Orientation:

- Question: "Are you straight, gay, or bisexual?"

- Advice: You can dodge this question by stating, "I believe my sexual orientation doesn't influence my professional abilities or performance."

Political Affiliation:

- Question: "What political party do you associate with?"

- Advice: You can professionally respond by saying, "I prefer to keep my political views private as they don't impact my professional performance."

Salary History:

- Question: "What was your previous salary?"

- Advice: Instead of revealing your past salary, you can redirect the conversation by saying, "I'm more interested in discussing the value I can add to your organization and what a fair salary for this role might be."

Health and Disability:

- Question: "Do you have any health issues or disabilities?"

- Advice: It's best to respond by saying, "I'm fully capable of performing the duties outlined in the job description. If there are specific physical requirements, I'm confident we can address them appropriately."

Religious Beliefs:

- Question: "What is your religion?"

- Advice: Address this question by responding, "My religious beliefs are personal and I don't see how they might impact my professional obligations."

Essential Questions to Ask During Your Bank Teller Job Interview

Engaging in a job interview is not just about answering questions, but also about asking the right ones. Tailoring questions to the specifics of the role you're applying for shows your genuine interest in the position, as well as your desire to become a part of the organization. For a Bank Teller position, you should consider asking these five questions:

- "What does a typical day look like for a Bank Teller in your bank?"

This question shows your eagerness to understand your potential daily duties and responsibilities. It will also help you understand how your day-to-day tasks align with the company's operations.

- "What is the bank's approach to customer service?"

This question demonstrates your understanding of the importance of customer service in the banking industry. It also gives you insights into the bank's values and how they interact with their clients.

- "What types of training and development opportunities does the bank offer?"

As an aspiring employee, you want to grow both personally and professionally. This question not only shows your enthusiasm for learning and development, but also your ambition to progress within the bank.

- "What are the key challenges facing this role?"

The answer to this question will give you a clear idea of what to expect and what will be expected of you. It shows that you are not afraid of challenges and are prepared to deal with them.

- "What qualities would make someone really successful in this role?"

This question shows that you are not just interested in getting the job, but also in being good at it. It will also give you an idea of how to tailor your skills to the demands of the role.

Mastering Key Phrases for Your Bank Teller Position Interview

In the following section, we will provide you with a list of beneficial tips and phrases that will prove extremely useful during an interview for the position of a Bank Teller. Crafting your responses with the help of these suggestions could increase your chances of securing the role.

Honing Your First Impressions: Preliminary Interview Tips for Aspiring Bank Tellers

The significance of a first impression cannot be overstated, especially when attending a preliminary job interview for a Bank Teller position. This initial encounter sets the tone for the entire interview process and can significantly influence the hiring manager's perception of your suitability for the role. As a prospective Bank Teller, your first impression should convey professionalism, competence and a strong customer service orientation. It may be the deciding factor between progressing to the next stage or being eliminated from the applicant pool.

- Dressprofessionally to show respect for the bank and the position.

- Show up on time or early to demonstrate reliability and seriousnessabout the job.

- Prepare for the interview by researching the bank and the role of a bankteller.

- Bring multiple copies of your resume and any other supporting documents.

- Provide concise, clear answers to interview questions.

- Maintain positive body language, making eye contact and offering a firmhandshake.

- Showcase your customer service skills, as this is key for the role of abank teller.

- Demonstrate your ability to handle money responsibly and accurately.

- Show enthusiasm for the role and the banking industry.

- Highlight your attention to detail and problem-solving skills.

- Discuss any past experiences relevant to the role, such as cash handlingor customer service.

- Show your willingness to adhere to bank policies and regulations.

- Be prepared to answer questions about how you handle difficult customersor stressful situations.

- Ask insightful questions about the job or the bank to show your interestin the role.

- Thank the interviewer for their time and express your interest in movingforward with the hiring process.

Understanding the Bank's Profile: A Crucial Step in Preparing for Your Teller Position Interview

Understanding the company you're interviewing with is crucial to your success. It not only demonstrates your genuine interest in the role, but also equips you with the ability to articulate how your skills align with the company's goals. This knowledge can set you apart from other candidates, showcasing your initiative and commitment. It further allows you to assess if the company's values align with yours, fostering a potential beneficial relationship. The power of preparation should never be underestimated, as it can significantly influence the trajectory of your career journey.

Besides these interview preparation suggestions for Bank Teller, we also offer CV templates you might find useful.

- Floor Manager CV

- Floor Manager cover letter

- Floor Manager CV entry level

- Banking Center Manager CV entry level

- Banking Center Manager CV

- Head Cashier CV entry level

- Banking Center Manager cover letter

Honing Your CV: The Key to Landing Your Dream Job as a Bank Teller

A well-crafted CV is critical when applying for a job or preparing for a job interview, especially for a position such as a Bank Teller. The CV essentially serves as your professional introduction to the potential employer, highlighting your qualifications, skills, and past experiences relevant to the job. A comprehensive and detailed CV significantly increases the chances of landing a job interview and, eventually, securing the position. The top part of the CV should contain your contact details, including your name, phone number, and email address. Following that, there are several main parts of the CV that you should not overlook while applying for the role of a Bank Teller.

- Professional Profile: This is your chance to make a great first impression. Introduce yourself professionally, highlighting your core competencies, personal characteristics, and career objectives. For instance, you might mention your keen numerical accuracy, customer service skills, and your ambition to progress in the banking sector.

- Professional Experience: Here, list your previous jobs chronologically, starting with your most recent position. Each job should have a brief description of your role, responsibilities, and any notable achievements. In the case of a Bank Teller, you might mention your experience in handling cash transactions, customer service, and compliance with bank procedures.

- Skills: This section should include both your hard and soft skills. As a Bank Teller, essential skills would be numerical proficiency, attention to detail, customer service, and knowledge of banking software. Give instances where you've used these skills in the past to bring tangible results.

- Education: Provide details of your academic background relevant to the position. If you have a degree in finance or business management, mention it here. Also, include any relevant training or certifications, such as a certificate in banking services.

- Additional Sections: This could include any other information not covered in the previous sections but still relevant to the job, such as language proficiency or any awards you've won. For instance, being bilingual could be an advantage in a diverse community bank.

Unleash your career potential by crafting the perfect Bank Teller resume with our intuitive resume builder, just a click away!

Navigating a Bank Teller Job Interview Without Prior Experience

Securing a job as a Bank Teller with no prior experience can seem daunting, but with the right preparation, it's entirely possible. The subsequent tips are designed to help you successfully navigate through the job interview process. They aim to help you highlight your transferable skills, demonstrate your potential, and convince your prospective employer that you are the right fit for the Bank Teller role.

- Researchthe Role: Understand what a bank teller does. This includes the typicalday-to-day tasks, the skills needed, and the qualities that make a successfulbank teller.

- Understand the Banking Industry: Get a basic understanding of thebanking industry, its main functions, and key terms. This will show that you'reinterested and proactive.

- Highlight Relevant Skills: Even without experience, you may have skillsrelevant to the job. These can include customer service, cash handling,problem-solving, or numeracy skills. Show how you gained these skills in othercontexts.

- Prepare for Common Interview Questions: Be ready to answer typicalquestions like "Why do you want this job?", "Why should we hireyou?", and "Tell me about a time you handled a difficultsituation".

- Show Your Interest in the Company: Research the bank you're applying to.Understand its products, services, values, and culture. Be ready to explain whyyou want to work there specifically.

- Demonstrate Your Willingness to Learn: Without experience, you'll needto show that you're eager and capable of learning the job. Discuss any personalor school experiences where you quickly learned new skills.

- Practice Simulation: Try to simulate a bank transaction at home. Thiswill help you understand the role better and show your initiative.

- Prepare Questions for the Interviewer: Asking insightful questions showsyour interest in the role and the company.

- Dress Professionally: Bank tellers are customer-facing employees, soappearance matters. Dress professionally for your interview to make a goodfirst impression.

- Be Positive and Enthusiastic: Show your enthusiasm for the job and thebanking industry. This can help compensate for a lack of experience.

- Use Examples: When discussing your skills, use specific examples fromyour past to demonstrate them. This makes your skills more tangible andbelievable.

- Mock Interview: Practice your answers with a friend or mentor. This canhelp you feel more confident and prepared.

Honing and Showcasing Your Key Soft and Hard Skills for a Bank Teller Interview

In the interview for a Bank Teller position, showcasing both your soft and hard skills is critical as recruiters are looking for a blend of both. Hard skills, including cash handling experience, knowledge of banking procedures, and ability to use financial software, demonstrate your capability to perform essential job tasks. On the other hand, your soft skills such as customer service, communication, problem-solving abilities, and attention to detail, highlight your potential to interact effectively with customers and team members, handle issues efficiently and maintain a high level of accuracy in your work. Recruiters are looking for a candidate who can not only perform the technical aspects of the job but can also provide exceptional service to bank customers.

Below, we will be showcasing a list of potential soft and hard skills that may prove beneficial during a job interview for the position of a Bank Teller.

Soft Skills:

- Communication Skills: As a bank teller, excellent verbal and written communication is crucial as it involves daily interaction with clients, explaining complex financial terms in a simple manner.

- Customer Service: Ability to provide exceptional service to customers, ensuring their banking experience is positive. This includes being patient, attentive, and understanding.

- Attention to Detail: Accuracy in handling cash and recording transactions is essential in a banking environment to prevent errors.

- Problem-Solving Skills: Ability to identify, analyze, and solve problems that might arise, enhancing customer satisfaction.

- Teamwork: Ability to work well with others, contribute to team efforts, and foster a supportive working environment.

Hard Skills:

- Cash Handling: Proficiency in counting cash, receiving deposits, and processing withdrawals accurately.

- Financial Software Proficiency: Ability to use banking-specific software for transactions, data entry, and record keeping.

- Basic Accounting Skills: Understanding of basic accounting principles to manage transactions and balance cash drawers.

- Regulatory Compliance Knowledge: Familiarity with banking rules and regulations to ensure all transactions are compliant.

- Bilingual/Multilingual: Ability to communicate with customers in multiple languages can be a significant advantage, expanding the bank's customer base.

Choosing the Appropriate Attire for a Bank Teller Job Interview

In conclusion, it is essential to dress appropriately and professionally when attending a job interview, especially for a position like a Bank Teller that requires constant customer interaction and a professional demeanor. Your attire should make a statement about your seriousness, commitment, and suitability for the job. Here are some practical tips that can help you make the right impression:

- Opt for a professional business attire: A suit in a conservative color like navy blue, black or grey is ideal for both men and women.

- Choose a well-fitted outfit: Ensure your clothes fit properly and are not too tight, too loose, or too revealing.

- Keep your shoes polished and professional: For men, leather dress shoes are preferred. Women should opt for low to medium-heeled shoes.

- Maintain a neat, clean, and professional hairstyle: Your hair should be well-groomed and not distract from your professional appearance.

- Limit your accessories: Keep jewelry, watches, and other accessories minimal and tasteful.

- Avoid strong fragrances: Some people are sensitive to certain scents. It's best to err on the side of caution and avoid wearing strong perfume or cologne.

- Ensure your nails are clean and well-groomed: For women, if you choose to wear nail polish, opt for a neutral or soft color.

- Carry a professional bag or briefcase: This not only adds to your professional look but also allows you to keep your documents and other essentials organized.

Mastering the Second Interview for a Bank Teller Position

The second job interview for the position of a Bank Teller often involves meeting with higher-level management or a panel of interviewers to delve deeper into your qualifications, skills, and suitability for the role. This is typically a more detailed and rigorous process than the first interview. To prepare, review your first interview and identify any areas you need to clarify or expand upon. Research about the bank's services, culture, and values, and relate them to your experience and skills. Prepare to answer more in-depth questions about your ability to handle cash transactions accurately, deal with customers, and your problem-solving skills. Also, be ready to ask insightful questions to show your interest in the role and the bank. Don't forget to dress professionally and bring copies of your resume or any other relevant documents.

Enhancing Your Bank Teller Job Application: Additional Elements to Consider

Below we present a list of additional positive elements that a candidate can bring up during a second job interview for a Bank Teller position:

- Ability to provide excellent customer service: Having a prior experience in a customer-facing role can be a great asset in this position. Emphasize on how you've consistently maintained strong customer relationships and improved customer satisfaction in your previous roles.

- Strong numerical skills: As a bank teller, handling money is a day-to-day task. Highlighting your accuracy in handling money and your attention to detail can be a great advantage.

- Trustworthiness: As a bank teller, you will be trusted with large amounts of money. Demonstrating your trustworthiness and integrity can assure the employer that you are reliable and responsible.

- Technological proficiency: Banks are increasingly using technology in their operations. Showcasing your ability to quickly learn and adapt to new technologies can be a plus point.

- Sales skills: Many banks expect their tellers to sell their products to customers. Highlighting any previous sales experience, or your ability to persuade and negotiate can be beneficial.

- Ability to work under pressure: Banks can be fast-paced, high-pressure environments. Provide examples of how you have successfully handled such situations in the past.

- Career aspirations in the banking sector: Expressing your long-term career goals within the banking industry can show the employer that you are committed and likely to stay with the company for a long time.

- Team player: Banks rely heavily on teamwork. Mention your experience and skills in working as part of a team.

- Bilingual or multilingual skills: If you are proficient in more than one language, this can be a great advantage, especially in areas with diverse customer populations.

- Previous banking experience: If you've worked in a bank before, even in a different role, this can give you an edge. It shows you are familiar with the banking environment and practices.

- Excellent problem-solving skills: Highlight how you have used your problem-solving skills to handle challenging situations effectively in your previous roles.

- Willingness to learn: Express your eagerness to continually learn and adapt, as the banking industry is ever-evolving.